Monsanto Company reaches an agreement with the U.S. Securities and Exchange Commission (SEC) fully resolving a previously disclosed SEC investigation into the financial reporting of the company’s customer incentive programs related to glyphosate products in fiscal years 2009, 2010 and 2011. The investigation was first disclosed by Monsanto in fiscal year 2011.

In agreeing to the settlement, Monsanto neither admits nor denies the SEC’s allegations that the company violated certain provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934. Under the terms of the agreement, Monsanto will pay an $80 million civil penalty, which was fully reserved for and previously disclosed in the company’s financial statements for fiscal year 2015. Monsanto will also retain a consultant to conduct a review of the company’s financial reporting of customer incentive programs for its crop protection business.

Monsanto is committed to operating its business with the utmost integrity and transparency and in compliance with all applicable laws and regulations, the company said in a statement. “The company is pleased to put this matter behind it and remains focused on building value for its shareowners, while continuing to provide innovative technologies and products for farmers to improve farm productivity and food quality,” the statement read.

The settlement does not require any changes to the company’s historical financial statements. As previously announced in November 2011, following an internal investigation, Monsanto restated its financial statements for fiscal year 2009 through the third quarter of fiscal year 2011.

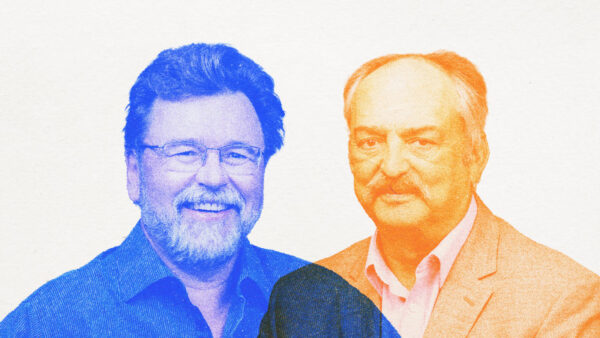

In connection with the settlement, Monsanto’s Chairman and CEO, Hugh Grant, and former CFO Carl M. Casale, have reimbursed the company for cash incentives and certain stock awards that they received in fiscal year 2009 and fiscal year 2010. The SEC did not pursue any enforcement actions against Messrs. Grant and Casale, nor did the SEC allege that these executives engaged in misconduct. Under Section 304 of the Sarbanes-Oxley Act, however, when a company restates its financial statements as a result of misconduct, the CEO and CFO are required to reimburse the company for certain incentive compensation even if they did not personally engage in that misconduct.