With the increased demands being place on the seed, this niche sector of the industry is set for rapid growth.

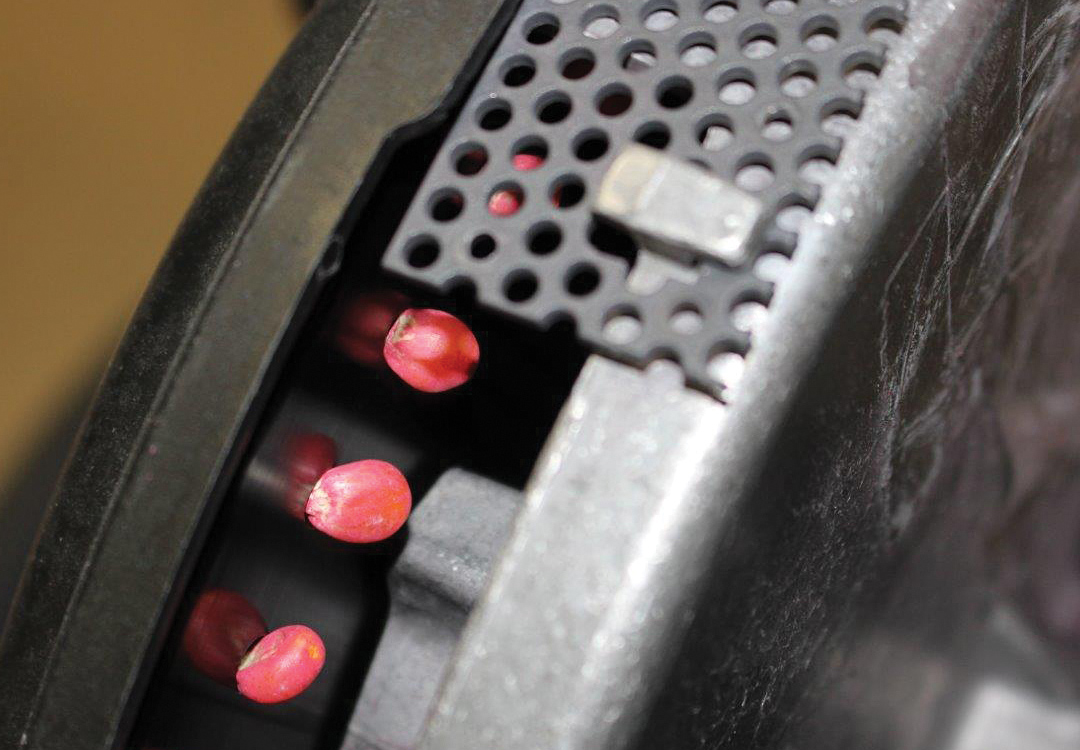

More and more, seed is seen as the delivery mechanism for plant growth stimulants and active ingredients that help protect plants from insect, disease and fungal pressures. As more inputs are added to the seed, it drives innovation in seed coatings and polymers to keep it all together on the seed.

In exploring the advancements being made in the area of polymers and seed coatings, it’s important to understand the terminology.

Bob Legro, who serves as INCOTEC Group BV director for research and development, explains that when the seed industry talks about treated seed, “the common understanding is that seed is treated with a crop protectant.”

With headquarters in the Netherlands, INCOTEC serves the global market with seed enhancement technologies that maximize seed performance. These include upgrading, priming, disinfection, film coating, encrusting and pelleting, applying additives and analytical quality testing.

Legro defines a seed coating as the “formulation that’s layered on the seed.” He explains that there’s film coating, which is common practice for field crops; encrusting, which is a minimal change of the shape and size of the seed to make it easier for handling and planting; and pelleting, which is a more substantial form of layering to make the seed more round for mostly mechanical planting.

In the seed industry, the film coating formulation excluding the active ingredients and biostimulants is often referred to as the “polymer.” Yet, as Legro defines it, technically speaking, a polymer is the binding component in the film coating formulation.

Another company that’s a key player when it comes to functional seed coatings and polymer technologies is BASF.

“Seed coatings keep active ingredients and other inputs on the seed; and therefore, maximize the productivity of the seed and seedling active ingredients,” says Eda Reinot, BASF Seed Solutions director of research and development within the Functional Crop Care business unit. “It has to be held together on the seed while enabling seed flow through the treatment process and seed plantability.

“Seed is valuable and so are the applied technologies.”

Reinot explains that BASF seed coatings have complex compositions that are specifically designed, formulated and tailored to meet the needs of specific customers.

A polymer, she says, is a component of a seed coating but it alone would not deliver the functionality needed.

Performance Matters

“Polymers help in multiple ways,” says Palle Pedersen, head of product marketing at Syngenta Seedcare. “Polymers help active ingredients stay on the seed, but it’s important to note that if the seed hasn’t been conditioned very well — meaning there is lots of dust on the seed from the seed itself — the polymers become ineffective and the active ingredients won’t stick well to the seed.

“It’s like sticking a piece of tape to a dusty shirt; it won’t stick very well because the tape can’t adhere to the material. Seed is the same way. If we don’t have effectively conditioned seed, the treatment won’t stick. Even though we have excellent polymers, that step is critical.”

Pedersen says that polymers help to decrease abrasion and dust, but also help to increase the flowability and plantability of the seed.

Pedersen adds that polymers need to perform (flowability and plantability) the same across environmental conditions — be it hot and humid, cool and damp or dry — to get consistent seed drop.

Reinot says that improvements to coatings and polymers ease handling for both seed dealers and farmers and enable precision planting. If the seed doesn’t flow properly through the planter, farmers will see skips and doubles, she says, noting that’s not making every seed count.

“For a crop, such as corn, that has a high correlation of seed rate to yield — flowability is everything,” Pedersen says.

In the quest to improve yields, companies must also be conscious of the environment and strive to improve sustainability. On this front, dust from the planting of treated seed can be an issue.

“With regard to abrasion and dust-off, we want our active ingredients to stick on the seed,” Pedersen says. “That’s what farmers are paying for. If it doesn’t stick, it can decrease the efficacy.”

At INCOTEC, the team is focused on reducing abrasion and dust-off and improving flowability.

“We need to have good flow at all levels, from treatment to bagging or packaging and seeding,” Legro says.

But it’s not just product performance that’s hurt when the seed coating and polymers don’t keep everything on the seed. Certain studies indicate that dust from neonicotinoid treated seed can be harmful to nearby pollinators.

Couple the demands of reducing dust-off with the need to add more ingredients to the seed, and the challenge for the seed coatings sector only escalates.

“The seed industry faces increasing pressure from regulatory bodies, especially regarding the use and safety of chemicals,” Legro says. “There’s consumer pressure to use fewer chemicals and find more sustainable solutions; therefore, we are constantly looking for other solutions. We have to change coatings very fast to address these demands.”

Reinot agrees. “The real estate on seed is limited — it’s a very defined surface area that you have to work with,” she says. “To allow more surface area for active ingredients (fungicide, inoculants and biostimulants), we are looking at ways to lower the application rate of our product while maintaining and improving its efficacy.”

One of the ingredients that’s shown tremendous growth in recent years is the area of seed applied biologicals. Legro shares that the increasing number of actives and biologicals requires new developments and modifications to the existing coatings.

“These need to be able to live on the seed and grow and develop with the young plant,” says INCOTEC’s Legro. “As such, we have to be aware of the interaction between the active ingredients and biostimulants. How do we design protocols to reduce negative interactions so all actives and biostimulants work in the most optimal way?

“For a company like ours, we are not selling active ingredients or biostimulants; we sell the application technology, including the carrier ingredients — polymers. It’s a priority that the carrier doesn’t negatively affect germination. We work with highly selected materials that are safe for seed and everything goes through a multi-year evaluation process. A good coating should not affect seed germination and healthy seedling emergence.”

Reinot says this is something her laboratory team pays close attention to early on in the research phase.

“We have to ensure that the seed coatings we develop are compatible with classical chemistries and biologicals and that they are compatible during the application process and once they’re on the seed,” Reinot explains.

“We have to ensure that the seed coatings we develop are compatible with classical chemistries and biologicals and that they are compatible during the application process and once they’re on the seed.”

— Eda Reinot

Up to The Challenge

Companies continue to invest in new product discovery. “We have more than 85 people working in research and development around the world and are continuously working on optimizing and customizing corn and soybean coatings for North America, Argentina, Brazil and China,” Legro says. “We are working on new generation formulations that out perform anything on the market.”

While Syngenta doesn’t directly develop, or sell, polymers, it is working with companies such as BASF, INCOTEC and others to make sure that polymers work best with their seed treatment formulations.

And BASF is gearing up to launch a new coatings product later this year.

“It will be a new category in the space,” Reinot shares. “With our best in class technology, we continue to break ground in seed coatings and this new product will show agronomic influence and benefits to the seed.”

The experts agree that the science and technology behind seed coatings and polymers has rapidly evolved during the past five to 10 years, creating more complexity among offerings.

“If you go back to when film coating was just starting, life was relatively easy,” Legro says. “We had a limited portfolio of different coatings that would fulfill all our customers’ requirements, but as demand has increased, we really have to go much deeper into understanding coatings and how they work with seed and active ingredients.”

As a result, INCOTEC has expanded its research team and plans to continue growth in that area. “We are conducting more extensive research to better understand flowability, dust, abrasion, appearance as well as interactions with active ingredients and biostimulants,” Legro explains. “Industry demands far more advanced seed coating technology characteristics than 10 or 15 years ago.”

It’s not just the product portfolio that’s evolved; Pedersen adds that the technology has changed.

“The use rates and reduction of dust has improved significantly since we first started planting treated seed,” Pedersen says. “Companies are changing and improving products across the whole seed treatment industry and polymers are one of them.”

Pedersen compares the improvement in dust reduction from seed treatments during the past five to 10 years to that of the automobile industry increasing miles per gallon on newer vehicles when it comes to fuel efficiency.

Forging the Future

Coatings and polymers are here to stay and increasing in use. Use is expanding in markets all over the world.

“The application of this technology will be highly driven by regulatory policies,” Legro says, noting that there will be shifts in how they are packaged. For example, he says film coating will need to be for use.

In the future, Legro anticipates that higher loading rates will demand more space on the seed. He explains that encrusting is already being used on seeds such as sunflowers, which are undersized. In the near future, encrusting will enable significant stacking of multiple active ingredients onto the seed.

Additionally, the higher levels of application will demand the need for seed drying. “We’ll see more and more application technology come onto the market,” Legro adds. “And more active ingredients and biologicals will continue to drive changes in formulation.”

BASF’s Reinot says that the seed treatment industry as a whole, combining crop protectants with seed applied technologies or seed enhancements, continues to grow as the technologies evolve. “We’re elevating the value of seed, and keeping all the ingredients on the seed maximizes the genetic potential of seed.”

She says as long as seed is on the market, the seed coatings sector will continue to grow. Reinot’s expectations align with the latest report from Markets and Markets Inc.

According to a September 2014 report on seed coatings from Markets and Markets, the existing seed coatings market is valued at $993.84 million and is projected to reach $1.4 billion by 2019, growing at a compound annual growth rate of 7.5 percent from 2014 to 2019.

“The market is growing steadily due to the increasing importance of seed technology,” the report’s authors wrote. “The market demand for progressive multifunctional seed technologies to avert the decreasing acreage and to increase seed performance is one of the driving factors of the market. … Polymers are the major contributors toward performance enhancements of coatings materials. They also dominated the seed coating materials market followed by colorants and binders in 2014.

“North America and Europe are the top-two consumers of seed coating materials in the world. U.S. and France are key countries in North American and European regions, respectively, and these countries are growing with CAGRs of 8.1 percent and 9 percent from 2014-2019. Some developing countries such as China, India and Brazil are also growing at a rapid pace because of the rising domestic demand and industrialization.”

Pedersen reminds us that the seed treatment industry as we know it today is not that old, despite the fact that seed treatment has been used for thousands of years.

“It’s rapidly changing and helps farmers to maximize yield by planting early, despite cool and wet soils, reduced tillage practices while thereby reducing granular, infurrow and foliar applications,” Pedersen says, noting that he expects the industry will continue to evolve. “There will be new technologies to come that we haven’t even seen or thought of yet that will benefit both industry and growers.”