With the adoption of new technology around the globe, and more mouths to feed, the seed industry is experiencing rapid growth. What size is the global seed industry today and how is this going to change in the future?

According to the International Seed Federation, the global seed market was worth approximately $47 billion in 2012, with $9.9 billion of that total being internationally traded.

Marcel Bruins, secretary general of the ISF, says there is no question the global seed industry is growing in size. “The seed industry will continue to grow vigorously—this is not wishful thinking,” he says, adding the proof is in seed export numbers. “There has been a steady increase in global seed exports over the last few years—$4.5 billion in 2003 to $9.9 billion in 2011.”

Each year ISF collects export and import statistics of seeds, breaking the data down by quantity (in metric tonnes) and value (millions USD) of seeds for sowing. “We collect this data for all countries that reported a value of more than $1 million. On the export side that was for 68 countries and on the import side data was collected for 106 countries. The data includes all crops including flower seeds, but not seed potatoes,” explains Bruins.

Some striking developments in 2011 which signified size and growth, according to Bruins, included the following:

• The overall international value of seed trade (imports and export combined) has increased to slightly more than $19 billion, up from $16 billion in 2010.

• Seed exports in 2011 increased to $9.9 billion, up from $8.3 billion in 2010.

• France has become the largest seed exporting country with a value of $1.6 billion, closely followed by the Netherlands ($1.5 billion) and the United States ($1.4 billion).

• There was good growth of seed exports in Hungary, Latvia, Lithuania, Luxemburg, Pakistan, Peru, Romania, Slovakia, Thailand, the U.K. and Ukraine.

• There was a decrease of seed exports in Austria, Bulgaria, Colombia, Moldova and Sweden.

• Seed imports in 2011 increased to $9.1 billion, up from $7.8 billion in 2010.

• There was good growth of seed imports in Czech Republic, Georgia, Indonesia, Ireland, Latvia, Luxemburg, Moldova, Nicaragua, Serbia, South Korea, Sri Lanka, Ukraine and Uzbekistan.

• There was a decrease of seed imports into Burkina Faso, Ethiopia, Greece, Honduras, Iraq, Panama, Paraguay, Sudan, Sweden, Thailand, the U.K. and Uruguay.

Bruins says the import/export numbers for 2012 are being collected now and will be released later this fall.

Industry Analysis

There have been other reports released recently that focus on the size of today’s global seed industry and its outlook for the future.

According to a market report published by Transparency Market Research titled Commercial (Conventional and Biotech/GM) Seeds Market for Soybean, Corn, Cotton and Others—Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2012-2018, the global commercial seeds market was valued at $34.5 billion in 2011 and is expected to reach $53.32 billion in 2018, growing at a compound annual growth rate of 6.5 percent from 2012 to 2018.

According to the report, GM seed is leading that growth—the global GM seed market was valued at $15.6 billion in 2011 and is expected to reach $30.21 billion in 2018, growing at a compound annual growth rate of 9.9 percent from 2012 to 2018. “The growing population coupled with decreasing arable land is a key driver influencing the acceptance of GM seeds in the world,” says the report.

Corn was the largest commercially-grown crop, and accounted for more than 40 percent of global seed consumption in 2011. “Growth in this market is primarily fueled by the use of corn in the manufacturing of ethanol which is an alternate fuel type,” says the report. The commercial corn market is expected to reach $24.26 billion in 2018. Soybean, vegetable and cereals are the other largely consumed seeds and accounted for more than 35 percent of the global consumption in 2011.

In terms of what regions have market share, “North America was the largest market for commercial seeds accounting for over 30 percent of the total market in 2011. Asia Pacific and Latin America are expected to show the fastest growth over the forecast period owing to the evolving methods of farming in these regions,” says the report.

Comparing the Numbers

Bruins says that while these numbers are solid, ISF’s estimate of the global seed market today is close to $50 billion—a larger value. He says the difference in values is likely due to different methods of collecting data. “As with all statistics, it is very important to compare the right data. What goes in, comes out. Obviously there are different ways of assessing the value of the global seed market. One can include more or less countries, crops and other parameters,” he says.

ISF collects data on an annual basis from its members, focusing on the domestic market for seeds in each country for the year before, which includes field crops (pulses, cereals, industrial crops and forages), vegetable crops and flowers (herbaceous and non-herbaceous plants cultivated mainly for flowers). “We ask our members to collect data on the value of seeds for planting which is sold to end users,” explains Bruins, adding that while ISF doesn’t have the data of all 196 countries in the world, it does ask its members, for the countries not on this list, if they have data available to share as well.

Bruins expects that ISF actually underestimates the total value of the global seed industry, because “No. 1, we don’t have the data of all countries in the world, only of about a little over 100 countries. And No. 2, not all countries are able to provide us with data each year. As the seed market tends to grow, a non-answer in general leads to an underestimation,” he says.

Examining Growth Factors

A second report titled Global Seed Industry Outlook to 2016—Rapid Emergence of Genetically Modified Seeds, which was released earlier this year, also provides a comprehensive analysis on the size of the seed market including grain, horticulture, oil, vegetable and fruit seed. The report covers the sales of seeds across all the regions in the world with detailed coverage on Europe, Asia-Pacific, North America and Latin America. In particular, it focuses on 11 countries including the United States, Canada, India, China, Japan, Australia, France, Germany, Brazil, Argentina and Mexico.

According to this report, the global seed market has grown at a CAGR of 5.6 percent during the period of 2005 to 2011. The report highlights the reasons behind the growth of the global seed market. “This growth was primarily supplemented by the remarkably rising population and inflating agricultural commodity prices, especially during the year 2007 and 2008. Moreover, an increasing adoption rate of genetically modified crops throughout the globe has supplemented the sales value of the seed market in the recent past. In addition, increasing production of biofuel across the major economies with an objective to generate an alternative for the scarcity of traditional fuel has inclined the demand for corn seeds and oil seeds,” the report states.

The report also indicates that demand for commercial seeds was primarily generated in the emerging markets of Latin America such as Brazil, Eastern European countries, Asian countries such as India, China, Korea and several other southeast Asian countries. “The key success factor still remains associated with the technological developments and the innovation of new and improved seeds with specialized traits such as drought tolerant seeds,” the report states.

Who Owns Market Share?

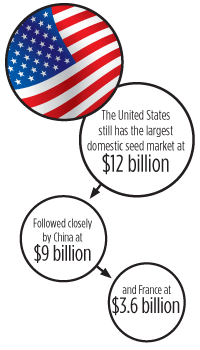

According to ISF statistics, the United States still has the largest domestic seed market at $12 billion, followed closely by China at $9 billion, France at $3.6 billion, Brazil at $2.6 billion, Canada at $2.1 billion and India at $2 billion—Japan, Germany, Argentina, Italy, the Netherlands, Russian Federation, South Africa, Spain and the U.K. round out the top 15.

Purdue University’s Center for Food and Agricultural Business focuses a considerable amount of attention on global behavior and economic patterns in the seed industry. Scott Downey, associate professor in the Department of Agricultural Economics and associate director of the CFAB, says increasing production efficiency in Asia, “makes this a market to keep our eyes on. In addition, Africa is seen by many as a great long-term opportunity. However, political and cultural challenges on both of those continents may restrict the speed of growth. Weather and prices/availability of other inputs are constant wrinkles that could affect this landscape,” he says.

The Future

Without a crystal ball, Bruins says it’s hard to predict exactly what the global market will look like in the future, but says a few things are certain. “There is likely going to be further consolidation, which will be offset by new start-ups and niche players,” he says. “Seeing that the seed industry is still far from the consolidation levels of the pharma or crop protection industries, we may see a further increase in consolidation, before a ‘balance’ is reached.”

Downey says no matter how you look at it, the seed industry definitely has growth potential going forward. “The population continues to grow around the world; therefore, food demand will be higher where political and economic forces don’t restrict consumption,” he says. “Genetic progress in drought tolerance should open lands on the margin or increase plant densities. Hopefully, that progress offsets challenges with water availability. Demand pressures potentially keep prices higher, although many suggest that some correction may occur. As long as prices are relatively high, land will be in production and the seed industry should continue to thrive and expand.”

Downey says the seed industry in the United States is in a very good position to capitalize on future global growth. “There is a lot of development that goes on here, of course, which makes the United States continue to be relevant,” he says. “And the variety of crops we’re capable of producing makes it a great place to innovate.”

|

For more information on the global seed industry’s outlook for 2016 visit reportlinker.com/p0922993/Global-Seed-Industry-Outlook-to-Rapid-Emergence-of-Genetically-Modified-Seeds.html. |

Domestic Seed Market 2012 (USD million)

| Country | Total |

| USA | 12,000 |

| China | 9,034 |

| France | 3,600 |

| Brazil | 2,625 |

| Canada | 2,120 |

| India | 2,000 |

| Japan | 1,350 |

| Germany | 1,170 |

| Argentina | 754 |

| Italy | 715 |

| The Netherlands | 590 |

| Russian Federation | 500 |

| South Africa | 454 |

| Spain | 450 |

| UK | 450 |

| Turkey | 400 |

| Australia | 400 |

| Korea | 400 |

| Mexico | 350 |

| Czech Republic | 305 |

| Hungary | 300 |

| China, Taiwan | 300 |

| Poland | 280 |

| Sweden | 250 |

| Greece | 240 |

| Romania | 220 |

| Denmark | 218 |

| Begium | 185 |

| Finland | 160 |

| Austria | 150 |

| Switzerland | 140 |

| Egypt | 140 |

| Morocco | 140 |

| Bulgaria | 120 |

| Chile | 120 |

| Nigeria | 120 |

| Serbia | 120 |

| Slovakia | 110 |

| New Zealand | 100 |

| Uruguay | 96 |

| Tunisia | 45 |

| TOTAL | 44015* |

| Source: ISF | |

*100+ countries. The commercial world seed market is assessed at approximately $47 billion for 2012.