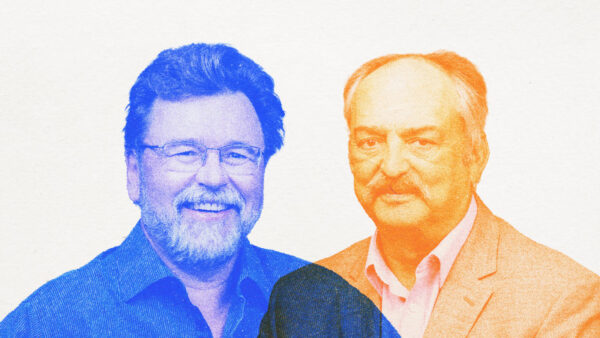

ASTA CEO Andy LaVigne asked questions after Basse, economist with AgResource Company, gave his annual global ag economic forecast at the 2024 American Seed Trade Association’s (ASTA) Field Crop Seed Convention.

At each ASTA Field Crop Seed Convention, one session packs the room: ag economist Dan Basse’s global ag economic forecast. That was certainly the case again this year, as an extremely interested crowd listened to Basse’s data-packed, hour-long presentation (recap of that presentation here). Following Basse’s presentation, ASTA CEO Andy LaVigne joined Basse on stage for a Q&A. The following is a shortened summary of that Q&A:

LaVigne: The backward slide we’re seeing in trade is impacting agriculture significantly. Dan, how do we define new uses to combat this?

Basse: We’ve got to think about innovative ways to handle this challenge. For instance, we could explore reducing tariffs on China or expanding biofuel programs like C45. Unfortunately, the Trump administration’s use of tariffs might not be as effective this time, as China has diversified its suppliers. Brazil and Argentina are now major players, so we’re no longer a central supplier. This trade war will likely see more resistance from China, but there’s still an opportunity to strike a deal.

LaVigne: How does the G7 view initiatives like the BRICS Belt and Road? Can they push back effectively?

Basse: The G7 has the strength, but it’s not cohesive right now. Meanwhile, the BRICS initiatives, like the Belt and Road and Free Trade Zones, are impressive and strategic. We’re undermining ourselves by not looking forward with a cohesive strategy.

LaVigne: Trade issues and the new administration’s potential tariffs have created uncertainty. How do you see this impacting our industry?

Basse: The impact trickles down to farmers and businesses alike. While we’re maintaining yields and adopting new traits, the global competition is fierce. China, for example, has been preparing for this trade turbulence by diversifying its suppliers and reducing dependence on U.S. goods. There’s still a chance for deals, but the positioning will be turbulent.

Audience Member: Last year, soybeans were highlighted as a bright spot due to renewable biofuels. This year, that’s not a major talking point. Why? And could commodities become a hedge against inflation again?

Basse: On soybeans and renewables, the market shifted due to boatloads of used cooking oil coming from China. California’s carbon credits favor used oil over virgin soybean oil, disrupting the market. However, Indonesia’s new palm oil blending mandate might tighten palm oil supplies, potentially making soybean oil a demand story again.

Regarding commodities as an inflation hedge, hedge funds and investors are looking at the stretched equities market. If a weather issue or other fundamental shift arises, we could see significant money flowing back into commodities, boosting the market.

LaVigne: Dan, a few quick-fire questions: Do you think the new administration will encourage a lower dollar value for stronger exports?

Basse: No, they’ll likely aim for a higher dollar. For Trump, a strong dollar and stock market reflect power. However, currency-related tariffs could be a wildcard, as we’re already seeing soybean trades in Brazilian reais instead of dollars.

Audience Member: Would we be in a different position if the Trump administration hadn’t renegotiated trade with China?

Basse: It’s hard to say. If the Biden administration had enforced the existing trade agreement, we might have seen different outcomes. Not enforcing it allowed China to change the playing field.

Audience Member: Is the progressive agenda — emphasizing energy, solar, wind and electric power — compromising food security?

Basse: Food security will always be a concern, especially with changes in agriculture. For instance, Europe’s push for organic-only farming creates opportunities for U.S. agriculture to fill gaps. However, the U.S. needs a long-term vision, not a constant flip-flop of executive orders. Consistency and longevity in policies are critical for progress.