Purdue University/CME Group’s Ag Economy Barometer improved 8 points in April to a new reading of 121. While the news is good, the reading remains 32% below its reading from the same time last year.

Growers’ outlook on current conditions and future expectations increased — with current conditions improving by 7 points to a reading of 120 and future expectations improved 9 points to a reading of 122. Particularly, Purdue notes that this increase comes from rising commodity prices.

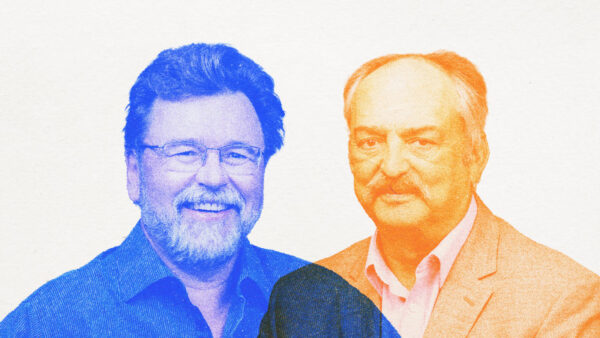

“Rising prices for major commodities, especially corn and soybeans, appear to be leading the change in producers’ improved financial outlook,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture, in a release. “However, it’s hard to overstate the magnitude of the cost increases producers say they are facing.”

As an example, the Eastern Corn Belt cash prices for corn rose more than 10% above their mid-March level in April — Purdue notes soybean prices rose as well. But, even as commodity prices increase, growers say higher input costs are their No. 1 concern, with 42% of growers surveyed reporting higher input costs as their biggest concern. That percentage was twice as higher as those who chose government policies (21%) or lower output prices (19%).

Producers expect crop input prices to continue to rise in comparison to 2022 crop inputs, with 36% of respondents expecting prices to rise by 10% or more, and 21% of crop producers expecting rises of 20% or more. Concern about the situation in Ukraine also is increasing anxiety about input prices.

Read the full report here.

Invasion of Ukraine Causes Price Spikes

While it’s still up in the air how the invasion of Ukraine will affect U.S. agriculture, research from Ohio State University says the shock to global commodity markets following the invasion is expected to be the largest in the post-war period.

Accounting for a quarter of global grain trade in the 2021-22 season, the report projects 16 million tons of grain to be stranded in Ukraine.

“Not surprisingly a market shock of this magnitude has affected both the volatility and level of prices, wheat futures at one point moving above $14/bushel, and eventually falling back to just over $10/bushel, reflecting uncertainty among traders about the invasion,” the report says. “In turn, the increase in grain prices, are having a significant effect on global food prices and hence food security.”

For the U.S., Ohio State believes higher fuel prices will continue to be prevalent, and fertilizer costs will be uncertain. But, overall, expecting a great deal of continued volatility is the only thing to say about the market with certainty.

Want to read more? Check out:

Food Prices Projected to Rise with Ukraine’s Invasion

Market Update: WASDE Predicts Ukraine Exports Dive, Overall Grains Decrease Globally

Prospective Plantings Report Shows Soybean, Not Corn, New King Crop