Sorghum seed demand continues to increase as established markets grow and more

end-uses are developed.

As a nutritional powerhouse with a multitude of established and emerging uses — including production of the most-consumed alcohol in the world, a Chinese liquor called baijiu — the future looks very bright for the sorghum seed industry.

According to Justin Weinheimer, Sorghum Checkoff Crop Improvement director, the sorghum seed market has remained mostly stable over the last few decades, at least within the U.S. commodity-based grain and broad-acre forage market.

However, at the same time, several segments such as grain and forage seed exports and food grade, or specialty sorghum seeds, have grown for U.S.-based seed producers, he says, as new end-users drive demand for “more attribute-based grain inputs.”

In terms of total sorghum grain production around the world, the U.S. tops all other countries. The grain is used to feed humans, companion animals and livestock; and for livestock, the stems and foliage are used for green chop, hay, silage and pasture feeding as well.

Another traditional strong domestic use is biofuel. At one time, nearly one-third of the U.S. sorghum crop went into its production.

U.S. sorghum grain exports are stronger than ever. In Mexico, China, Japan and other countries, it’s used for animal feed, but opportunities in ethanol production and food product manufacture are growing. Being gluten-free and non-GMO, with high protein and antioxidants levels and a low glycemic index, sorghum is a very sought-after grain.

And demand for U.S. sorghum, in particular, is strong in most international markets. It’s long held a major competitive advantage due to consistent volumes of production and quality compared to grain produced for export elsewhere in Australia and in South American countries, primarily Argentina. Sarah Sexton-Bowser, managing director at the five-year-old Center for Sorghum Improvement at Kansas State University, explains that decades ago, breeders in the U.S. started selecting against tannins in the grain and brought them to near non-existent levels. This matters particularly for end-users, particularly livestock feeders.

Sorghum is also already being used in burgeoning newish markets where sustainable products are in demand, from fencing and insulation to packing peanuts and cat litter. The new markets are providing endless opportunities for growers and seed companies alike across the U.S.

Seed Company Views

With all sorghum’s versatile uses, it’s no surprise that S&W Seed has seen a steady increase in interest for sorghum among U.S. crop farmers over the past two years. Export markets are the greatest driver of demand according to Vice President of Sales and Marketing Mike Eade. And while seed demand for the upcoming year is difficult for him to predict, Eade says all market indications point to continued strong demand from overseas.

Likely due mostly to export demand for the grain, total U.S., acreage increased 24% this year over 2020 to 7.3 million acres.

“Farmers use sorghum as a workhorse for their farm,” says Sexton-Bowser, who grows it with her husband at their own operation. “It serves as a commodity in crop production but markets like a specialty grain, so it’s a valuable crop choice.”

Colleen Shaw, global communications leader at Nuseed, notes that the current estimated 7.3 million acres is the highest since 2015, according to USDA data released in early September. She echoes Eade’s comments in terms of export demand being very strong, with “the largest driver of the market right now is the increased feed grain demand in China.”

“Because of the strong pricing and export demand, domestic use is actually down,” Shaw says. “Domestic use of sorghum for feed and ethanol were negatively impacted from near-historic pricing.”

Her colleague David Drinnon, general manager at Richardson Seeds (a subsidiary of Nuseed), adds, however, that there was a large increase in sorghum silage interest recently likely because water continues to be a driving factor in many production areas where sorghum’s natural water use is an advantage over other crops.

Tanner Antonick, Central U.S. sales manager for Alta Seeds — the U.S. brand for Advanta — says he’s also seen an increase in forage sorghum demand in places that haven’t had the rain to support corn silage of adequate quality, such as the Texas panhandle. Sorghum grows well in these locations for silage, and with lower input costs compared to corn to boot. The company has also seen a massive increase in herbicide-tolerant varieties in 2021.

Crop improvement specialists at the Center for Sorghum Improvement are currently working to add to the crop’s existing drought tolerance, developing lines that have improved yield stability and opportunity under water stress.

Additional agronomic emphases within public and private breeding programs, says Weinheimer, are traits linked to plant architecture such as height, stalk lodging and leaf structure. He adds that historically, agronomic trait focus in sorghum has mostly revolved around crop protection, “developing non-GMO traits for improved insect or weed control along with traditional efforts to increase yield and general agronomic performance.”

In terms of end-use traits for food and feed, breeders at the Center as well as in private industry are focusing on higher amino acid levels, specialty starch traits to increase digestibility, and more.

Food and Feed Market Development

Right now, across the country, according to Zach Simon, Sorghum Checkoff director of Ingredient Utilization & Pet Food, sorghum is being more used in human food applications.

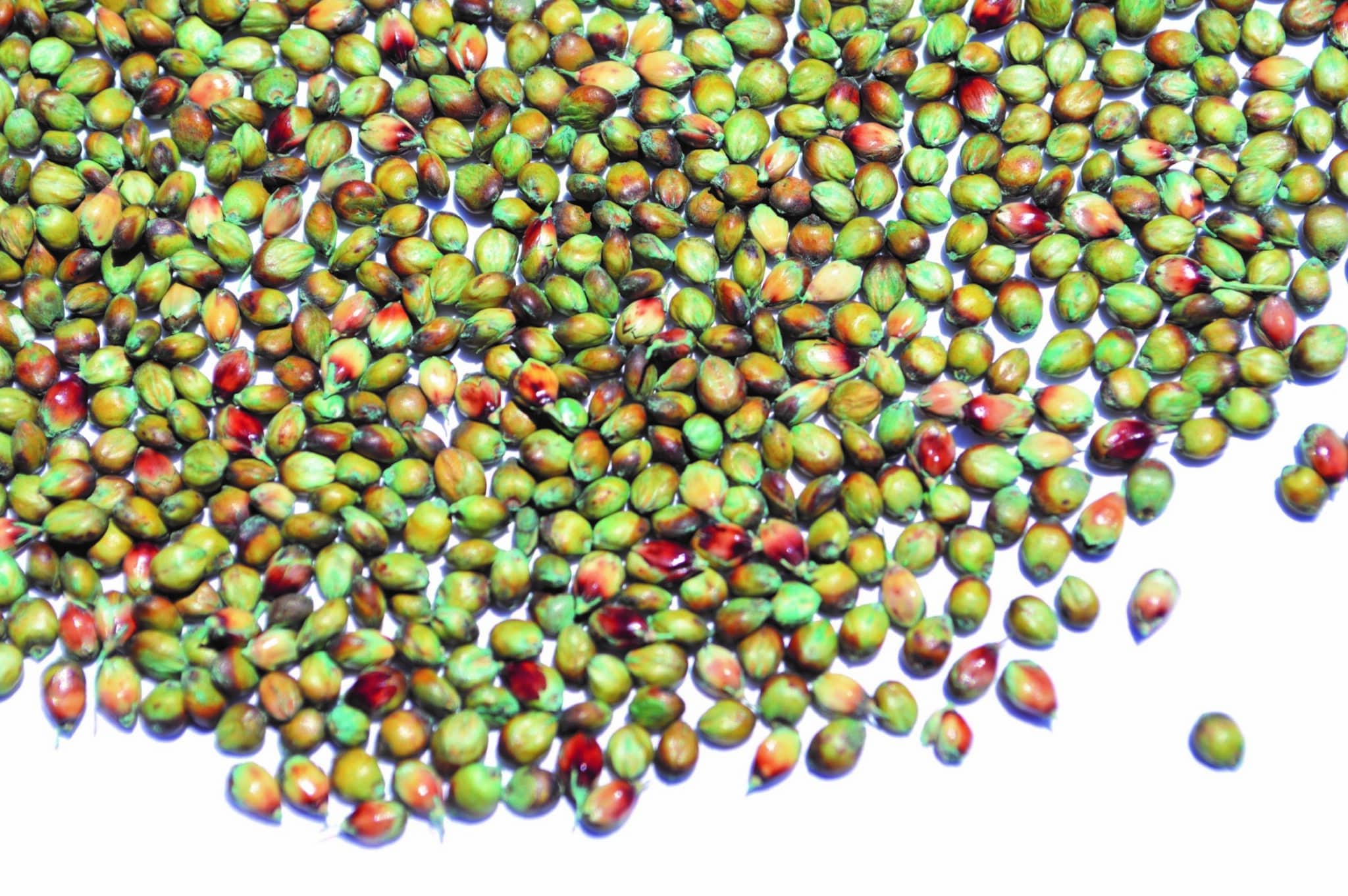

Red, orange and bronze-colored sorghum is used in all segments of the sorghum industry, but tan, cream and white varieties are typically made into flour. Black and burgundy varieties contain beneficial antioxidants and therefore go into specialized food product applications.

In total, the Checkoff reports that sorghum is now found in more than 350 product lines in the U.S. alone.

“Many of the same demand drivers for human consumption, including nutrition and palatability, translate directly to pet food demand, as well,” says Simon. The pet food industry has already incorporated sorghum in products that help control diabetes in companion animals because of its low glycemic index.

And due to its non-GMO status, high protein and other traits, sorghum is in demand in international feed markets.

“It’s an excellent energy source in swine rations and provides higher levels of lysine than other grains,” Simon explains. “Lysine is critical in swine diets to ensure a firm fat on the finished meat product.”

China in particular has turned to sorghum as a swine feed energy source as it continues to build back its national swine herd after the devastating African Swine Fever outbreaks of 2018.

Bright Outlook

Looking to the future, Simon and his colleagues expect to see sorghum’s international market demand expand, for both animal feed and human nutrition.

“Specifically, we see opportunity for an increase in the European and Asian pet food markets,” he says, “as well as a key ingredient in aquaculture rations, globally.”

Within the expanding global aquaculture industry, there is a strong interest in plant-based feed components, which are often perceived as more sustainable than some animal protein ingredient sources. Sorghum has many applications in the aquaculture industry as dried distillers grains, sorghum mill feed and extruded pellets. In addition to having high amounts of protein, sorghum can also serve as an acceptable plant-based energy source for fish, due to its high starch content and low anti-nutritional fiber levels.

With all of its valuable attributes and so many market opportunities, sorghum seed demand seems sure to increase further in 2022 and beyond.

Want to Read More? Check Out:

IPSA is Ready for Action at the 33rd Annual Conference

Alternative Protein Growth is Skyrocketing. Are You Ready for it?