In 2020, a year that will long be remembered for a variety of reasons, organic seed companies saw a historic surge in sales. In some cases, says Kiki Hubbard of the Organic Seed Alliance, companies experienced a tripling in sales compared to the year before.

“The surge in demand provided challenges in managing distribution in a timely manner,” Hubbard says. “COVID concerns led to restrictions in the workplace as well, which meant these enterprises were working with fewer staff to fulfill sales. As the year comes to an end, companies report that sales are still much higher compared to past years, and so now, inventory concerns loom large.”

The increased demand for organic seed is an important opportunity for organic seed growers to scale up their operations, if their production capacity allows, to fulfill more seed contracts with seed companies, says Hubbard.

“We believe the increased demand for organic seed can be attributed to a combination of events, including panic over food supply chain disruptions and food security concerns, and growing interest in gardening now that more people are thinking about the source of their food and spending more time at home,” Hubbard adds.

Explosive Growth

The demand for organic products in North America and around the world has been growing explosively over the past decade. According to the USDA’s Economic Research Service, consumer demand for organically produced goods has shown double-digit growth during most years. Organic products are now available in nearly 3 of 4 conventional grocery stores, usually carrying premium prices over conventional products. Organic sales account for over 4% of total U.S. food sales, and a larger percentage in many categories.

Sales in the U.S. for organic fruits, vegetables, meat and milk increased by 31% in 2019 over the prior year to $9.93 billion, according to the USDA. California leads the nation in organic sales and acreage, with 3,012 organic farms covering close to 1 million acres that generated more than $3.5 billion in sales in 2019.

According to Canada Organic Trade Association data for 2017, there were 4,800 organic producers in Canada and an estimated 3.2 million acres of organic crop production.

The growth in demand for organic products has likewise fueled significant demand for organic seed for row crops, fruits and vegetables.

Row Crops

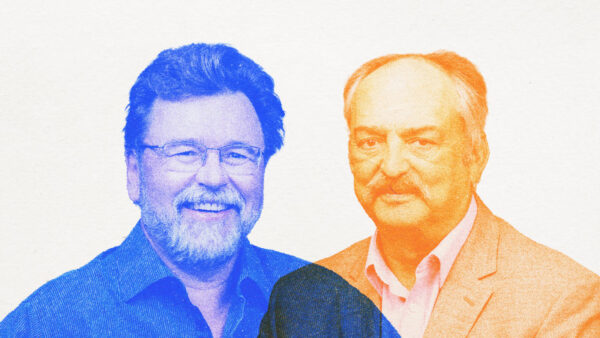

The demand for organic row crop grain, corn and soybeans particularly, continues to go up but the rate of growth is slowing, says Mac Ehrhardt of Albert Lea Seed who co-chairs the American Seed Trade Association’s (ASTA) Organic Seed Committee with Erica Renaud of Enza Zaden.

“Growth in demand for organic seed will continue to be good for row crops and fruits and veggies,” Ehrhardt says. “However, there are a couple things that may be lowering prices for organic grains. We have seen in 2020 a dramatic drop in the price of organic corn, down from about $8.50/10 per bushel to $6 for the organic seed needed for animal production.”

Ehrhardt cites three reasons for the decline in organic row crop seed prices. First, he says, “organic farmers have gotten better at producing corn, with many organic growers harvesting 180 bu/acre or more.” Secondly, production of organics is up because of the transition of acres from traditional cropping systems to organic. Thirdly, he says, increasing imports provide a constant downward pressure.

Ehrhardt says that unlike corn, organic soybean prices remain strong, in Oct. averaging in the $18-20/bu range versus about $10 for conventional grain.

The markets for organic wheat and oats are maturing and Ehrhardt expects to see “ups and downs in prices as we go forward.”

Continuing Growth for Vegetables

Andrea Tursini, High Mowing Organic Seeds, believes the demand will continue to trend upward.

“We are anticipating continued growth in the market for organic seeds,” says Andrea Torsini of High Mowing Organic Seeds. “According to the Organic Trade Association, organic produce sales were on the rise before COVID-19 and are even more important to consumers now.

“Organic farmers have been impacted by poor sales to restaurants since March,” says Torsini, “but we are seeing many of our customers turning to direct marketing and doing quite well with it. Further, home gardening has spiked significantly since March and we expect a good portion of these new gardeners to continue with the hobby.”

Tursini adds that supplies are strong for vegetable seeds. “There are, of course, normal crop failures or short crops as there are in any given year, but we are not seeing industry-wide seed shortages. If demand from home gardeners continues this season at the pace of last year, we may start to see some weak spots in OP varieties while seed growers are waiting on new crops. However, hybrid varieties remain plentiful and High Mowing, in particular, is well stocked in both hybrids and OPs.”

Roy van Wyk, Executive Director of the Canadian Seed Institute (CSI), says there appears to be a shortage of inputs for Canadian organic producers.

“There is more organic seed available but in Canada it is harder to find domestically produced organic seed,” he says. “Most of the organic vegetable seed is imported from the U.S. or Europe.”

Many Challenges Ahead

“The pandemic has made it harder for producers to source seed,” van Wyk says. “Nevertheless, suppliers have done a good job supplying seed and other inputs safely. They also are doing a good job providing seeds that are adapted to low inputs, harsh environments and resistance to pests.”

“Growers that we work with are struggling with climate change,” says Tursini. “Many crops require specific conditions to produce high quality seed. As weather becomes increasingly unpredictable and more extreme, seed growers are finding that what once worked well for them is no longer reliably productive. We may start to see shifts in where we can produce specific crops.”

Even before COVID hit, demand for organic vegetable seed was already increasing steadily in part because certified organic acreage is growing and sourcing certified organic seed is a regulatory requirement for these operations (when commercially available), Hubbard says.

Taking a longer view, Ehrhardt says he wonders how the organic industry will deal with the ban on gene-edited seed, currently barred by the U.S. National Organic Program (NOP).

“Generally, they are going to exclude the use of novel breeding techniques such as CRISPR-Cas9 technology and other gene-editing methods. The conventional seed industry is going to move forward quickly to adopt these powerful techniques because they are cheaper to use in the development of new varieties than traditional GMOs. Organic seed companies such as ours and others have relied on traditional breeding programs for germplasm. Where will new organic seed varieties come from if most breeding programs are using gene editing?”

Ehrhardt adds that if demand continues to grow, there will be companies who fund advanced breeding programs for organic seed. “Universities and others want to use new techniques because they are training the next generation of breeders. There will be challenges, but this problem has yet to be examined by organic food industries.”

Where Do We Go from Here?

Citing the study The Market for Organic & Ecological Seed in Canada by Marie Eve-Levert, van Wyk says one recommendation is to develop a coordinated approach among organic certification bodies with regard to data collection and approaches to seed derogations. Data from organic certification bodies can be used to help quantify the economic contribution of local organic seed as a means to help build a case for support to producers and purchasers to invest in the sector over the long term.

“I would suggest we develop a coordinated approach between the seed industry and the organic industry,” van Wyk says. “By nurturing a spirit of understanding and focusing on what the two industries have in common, we will realize the opportunity and make significant progress to grow the supply of organic seed.”