The announcements of all the seed and crop protection mergers and acquisitions during the past two to three years might have left some with a less-than-optimistic outlook as it relates to product innovation and commercialization, and at what price point on the farm.

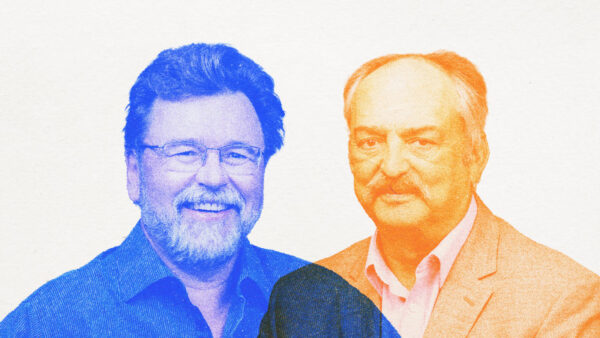

But for Adrian Percy, Bayer global head of R&D for the Crop Science division, that couldn’t be further from the truth.

“I think we are in a Golden Age … because a lot of things are coming together right now,” Percy said during Bayer’s annual AgVocacy Forum, which took place Feb. 25-26 in Anaheim, California. He noted the advancement of data-driven agriculture, plant breeding innovations and emphasis on understanding the soil microbiome.

Much of this work has only been going on since about 2013/14, he said, adding that it’s really early in the pipeline.

“The money that’s been invested will start to pay dividends in the next few years,” Percy said. “Then we will start to see a lot of new tools and approaches coming through the industry’s pipeline.”

The important thing, he said, is to get more investment in agriculture.

“[Agriculture has] lagged behind other industries in terms of the amount of investment,” Percy shared, noting that there’s been a real shift change in the past couple years. “I’d like to see even more money coming in, but with what we already have now, it’s going to be positive.”

You can listen to Percy here.

According to AgFunder, that investment is happening. In its “Agrifood Tech Investing Report: Mid Year Review 2017,” the company reported that agriculture biotechnology was the fourth largest category it tracked in the first half of 2017 (H1); however, year-over-year investment declined to $262 million and deal activity declined to 30 deals. Crop technologies still accounted for the majority of funding and deal activity. Here’s a brief excerpt from the report:

“Farmtech investment represented a quarter of total agrifood tech funding in H1-2017, reaching $1.13 billion, and accounting for seven of the year’s top 20 deals. The funding total represents a 56 percent year-over-year increase, but is still below the record-breaking 2015 when startups raised $1.3 billion in H1-2015. Deal activity contracted 14 percent year-over-year to 138 deals, with some large and later stage deals pushing the total up.

“The segment saw a few extra exits during the half with Indian irrigation giant Jain acquiring Australian water management and IoT platform Observant, and Monsanto’s Climate Corp acquiring another irrigation-focused data startup (and portfolio company) HydroBio of the U.S. The late summer acquisitions of Granular ($300m) and Blue River Tech ($305m) missed the cutoff for the H1 report, so we expect to report significantly more activity in the full year report.”

Bayer’s Percy said: “You can see that we are in a situation where technologies, such as new plant breeding innovations, are actually enabling small- and medium-sized companies to really make some progress. It’s probably healthier than it was 5 and 10 years ago because we didn’t have the investment that we are seeing today, through venture capital and private equity and science enabling companies to pop up and be quite successful.”

Technology Spurs Startups

Just last week, Nat Graham, a postdoctoral associate at the University of Minnesota, spoke about the benefits of new plant breeding innovations, such as CRISPR-Cas9. Graham said this technology opens the door of opportunity for all plants and could mean greater diversity among more crops.

“We see gene editing as the way of the future for crop development,” Graham said, explaining that there’s a lower barrier to entry so he expects to see more products coming to market. “It’s all about less cost and less regulation, which means smaller businesses and academics can get into the business … and some of our improvements can actually make it into the market.”

Graham noted that his boss started Calyxt, a Minnesota company that combines gene editing with technical expertise to bring consumers and farmers added value to their food and crops.

Listen to Graham here:

Syngenta is also one of a number of companies taking advantage of this technology. Michiel van Lookeren Campagne, Syngenta head of Seeds Research, shares that they are working on drought tolerance for corn.

“We’ve edited a gene that we’ve found from our designer program,” Van Lookeren Campagne said. “Those plants can perform with less water, about 14 percent less water use.

“Genome editing is just a couple years old, so it will take a couple years before these products hit the market.”

DuPont Pioneer and the Broad Institute of MIT jointly hold the intellectual property to CRISPR-Cas9 and in late 2017 announced that they would nonexclusively license the technology.

“The promise of CRISPR-Cas9 technology in the hands of many will result in a wide array of benefits for the global food supply, ranging from higher and more stable yields of grains, fruits and vegetables for farmers; more nutritious, healthier and affordable foods for consumers; and, improved sustainability of agricultural systems for society,” says Neal Gutterson, DowDuPont vice president of Research & Development.