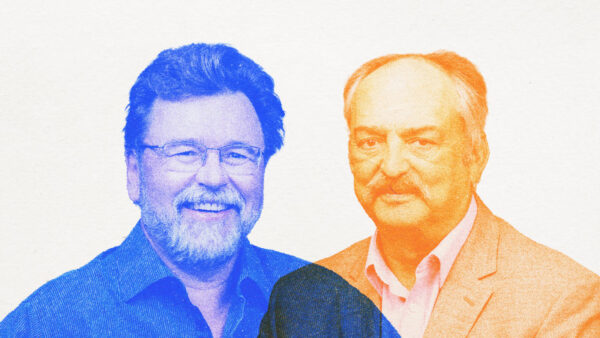

In a tight-knit industry where it often seems like everyone knows everyone else, Wayne Barton and Brent Collins didn’t meet each other until last year, oddly enough. But they’ve had to get acquainted quickly now that they work together as part of the new BASF Canada.

A lot of people at the Big 4 ag giants — BASF, Bayer, Syngenta and Corteva Agriscience (the spinoff ag company resulting from the DowDuPont merger) — are in the same boat.

“If you’re in industry or you’re a grower, there’s a good chance that the person you’re in the room with is being affected by the migration of all those assets that are moving around right now,” says Barton, BASF Canada’s manager of research and commercial development. “It’s a true industry migration right now, not just a couple of companies joining together but all the major players moving into new roles.”

Collins serves as BASF’s North American seed marketing manager. He recently came to BASF from Bayer, making the move after Bayer’s seed assets were acquired by BASF on Aug. 1, 2018.

BASF signed agreements in October 2017 and April 2018 to acquire the businesses and assets Bayer offered to divest as part of its acquisition of Monsanto. About 4,500 employees joined BASF through the acquisition, many here in Canada. The agreements include Bayer’s seeds businesses including traits, research and breeding capabilities, glufosinate ammonium herbicide brands, several aspects of Bayers seed treatment business, trademarks for key row crops in select markets and Bayer’s vegetable seeds business.

The arrangement puts Collins and Barton — and all of BASF — in a unique spot.

“BASF has been an innovative company — we’ve been looking at seed assets for most of the 20 years I’ve been with the company, but for various reason we weren’t able to get into the seed business until now,” Barton says.

“From a Canadian perspective, to acquire these assets couldn’t have come at a better time.

We’ve essentially been given the chance to disrupt our own business. People often talk of disruption in a negative or scary sense, but for us this was an ideal disruption all the way.”

Disruption from Within

Disruptive innovation is a term coined by Clayton Christiansen’s 1997 article The Innovator’s Dilemma. Disruption occurs when a smaller company with fewer resources unseats an established business. The smaller company is able to achieve “disruptive innovation” by targeting segments of the marketplace that have been neglected by the larger company.

This typically happens because the larger company is focused on the more profitable areas of their business and improving service for their most demanding customers. The new company is able to attract the overlooked customers with a new or innovative technology better suited for their needs. Think Netflix.

But when that disruption comes about willingly from within a company rather than outside of it, it offers a chance to fundamentally change things within that business.

“Every project we take on globally now has a bigger bang in Canada than it had before because we now have seed to go along with it,” Collins says.

“When a company that has a history in crop protection gets into the seed business, that already has a solid go-to-market strategy to deliver seed into the marketplace, it’s a major evolution. Both Bayer and BASF have lots of similarities in terms of the corporate culture, namely a focus on innovation and delivering value to the grower, so it’s been a very effective transition. It’s felt very natural.”

Culture Shift

That meshing of business cultures is integral to an effective transition, especially in regard to BASF’s new product offerings which it inherited from Bayer.

“We want to ensure a seamless transition, especially for our InVigor customers,” Barton says.

In the ag space, corporate culture can make or break a successful consolidation experience.

“We can’t just use existing cultures. We’re two different companies — one is German and one is American, so there will be differences,” says Leticia Goncalves, U.S. country head for Bayer’s Crop Science division. Part of her job is helping Bayer and legacy Monsanto employees through the transition after Bayer’s purchase of Monsanto in 2018.

“We need to create a new culture by defining our values and what we want to stand for. We just formed the new company last August. Our first priority is focused on customers and not disrupting the business while we integrate. It will take a few years to realize the benefits of the combination, and in the meantime, ensuring our cultural values are aligned is key.”

At the same time, Syngenta’s president Global Seeds, North America and China believes two corporate cultures can have more in common than differences. Jeff Rowe says ChemChina’s acquisition of Syngenta has provided a lot of stability that is helping Syngenta through a challenging global trade and economic climate.

“One question I get asked a lot is what is it like to now be owned by a Chinese entity. My first reaction is, ‘There’s not much I can tell you, it’s the same company it was before.’ Same values, same culture. The main thing that’s changed is we simply went from having a lot of investors to just one investor,” says Rowe, who moved over to Syngenta in 2016 after serving with DuPont Pioneer for over two decades.

“In a down cycle like the ag industry is going through right now, to be owned by a totally private entity with a long-term view is an advantage. There is a lot of stability there. I’m not aware of a single ChemChina employee who has joined Syngenta. That’s wouldn’t be a bad thing by any means. My point is that we have in no way been ‘taken over’ by ChemChina, other than being purchased by them. One thing that has indeed changed is we now have an even deeper commitment to grow our seed business, which is wonderful.”

Product Pipeline

While Syngenta’s product pipeline hasn’t changed as a result of the ChemChina acquisition, Bayer, BASF and the new Corteva Agriscience are all learning to navigate altered product portfolios.

For BASF’s Collins, taking over Bayer’s hybrid wheat research is particularly exciting.

“The hybrid wheat production system has been the biggest challenge in hybrid wheat commercialization. We’re confident what we have as a seed production system is effective for facilitating hybrid wheat to come into the Canadian marketplace,” he says. “Our timeline is still the mid-2020s for launching that technology. I’ve visited trials and seen actual hybrids in the field. It’s very impressive.”

Through acquisitions like Latin America’s Nidera Seeds, Syngenta is also expanding its product pipeline. Trevor Heck, president of Syngenta Canada, credits moves like the Nidera purchase to the acquisition of Syngenta by ChemChina, something he feels has given Syngenta a renewed enthusiasm for growth.

“We’ve committed to growth of our seeds portfolio. Under the old public trading model, we went through a period where we focused more singularly on growth from within. We now have more momentum to go out and do things,” Heck says.

But that can be easier said than done. Corteva Agriscience, itself a brand-new company formed as a spinoff organization after the merger of Dow and DuPont, has subsequently launched the Brevant seeds brand which was unveiled in Canada in 2018.

“Introducing a new seed brand and launching a new company at the same time has been an adventure,” says Brad Orr, marketing leader for Corteva Agriscience.

“Being part of a team responsible for building a new company that is focused on bringing an accelerated pace of agricultural innovation for the future is extremely exciting and rewarding. We spend every moment thinking about how to enhance the lives of farmers and consumers and their future generations.”

The key to realizing this “lofty ambition”, he says, is to establish relationships with strategic partners and leverage Corteva Agriscience’s brands, which also includes the Pioneer brand in addition to Brevant seeds.

“We strive for honesty and fairness in all that we do, building authentic relationships throughout the food system, and practicing responsible and sustainable agriculture. From producers to consumers, we work with others to play our part in advancing agriculture as an essential industry that fuels human potential.”

Marc Zienkiewicz is the editor of Germination, the voice of the Canadian seed industry. Germination is European Seed’s sister publication.