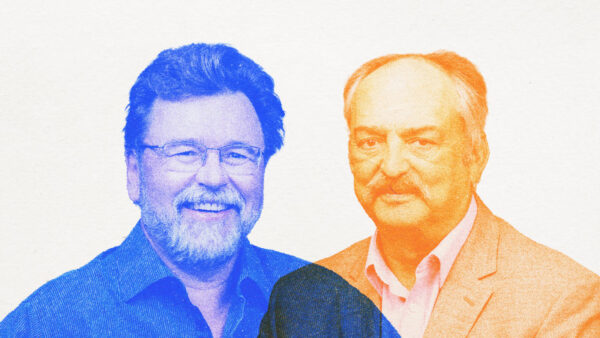

Speaking at AgriBusiness Global’s 2020 Online Conference and Trade Show, Dr. Bob Fairclough, Principal Consultant on Ag Market Insights at the U.K.’s Kynetec, presented insights on the crop protection market trends for 2020 & 2021.

Dr. Fairclough, a keynote speaker, discussed at length the current global market size and trends as well as external factors affecting the market including COVID-19 and currency movements. The data was largely derived from ongoing research by the former Kleffmann Group’s Ag Market Insights Division, which was acquired by Kynetec in late 2019.

One of the key takeaways from Fairclough’s talk was that the outlook in 2020 and indeed 2021 remains positive despite significant headwinds. According to the data, 2020 half year sales of most companies are up from 2019. There have been significant shifts in the fortunes of the leading companies when Q1 and Q2 are viewed separately, but when aggregated the half year sales of the leading companies are up some 1.7% in 2020 as compared to 2019.

Fairclough comments that, at this point in time, Ag Market Insights December 2019 forecast of 1.8% growth for 2020 over 2019 remains valid. However, Q3 sales (soon to be released) need to be watched carefully, especially for developments within Latin America.

He also shared insights on how mergers and acquisitions are reshaping the industry. Whilst the era of mega-mergers is over, mergers at all other touch points of the industry will continue. For example, late last month the Japanese corporations of Mitsui and Nisso jointly acquired a controlling interest in Bharat Insecticides Ltd, India. Such an investment continues the trend of a positive linking between Japanese innovation, trading and distribution strength and India’s chemistry production skill sets, commented Fairclough.

What is needed is much more balanced and science-based holistic appreciation of the value of crop protection products in the whole global food security debate.

Fairclough also delved into the launch of new active ingredients in the last 5-6 years. “With regard to new active ingredients, we’re seeing a greater focus on new proprietary chemistry. Whilst we are not at the same levels of new active ingredient introductions seen two decades ago, the increased rate of new product introductions has the capability to reduce the market share held by off-patent chemistry for the first time in decades,” he said.

He concluded that whilst current disruptive technologies are many, including an evolving distribution chain and FX headwinds, the most significant potential threat to the whole agricultural industry going forward was over-regulation, with the “greening” of policies globally now of major concern.

“It is no longer just an EU27 issue,” he said.

Agriculture, long known to be “recession proof” and, according to Kynetec’s latest impact survey, largely COVID-19 resilient, will ride out those storms as growers adapt. However, the over-regulation aspect is largely out of the control of growers. What is needed is much more balanced and science-based holistic appreciation of the value of crop protection products in the whole global food security debate, according to Fairclough.