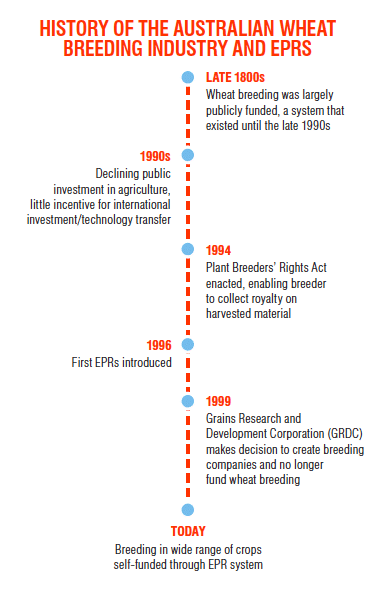

The land Down Under has had an end point royalty system for grain in place since the early 2000s. Here’s what that system looks like.

As discussions surrounding value creation continue, we thought it pertinent to take a look at how another country dealt with the issue of declining public investment in cereals breeding. Australia now utilizes an end point royalty (EPR) system in cereals, pulses and specialty crops. The following is based on information from Jason Reinheimer, senior breeder for Limagrain Cereals Research Canada based in Saskatoon. Reinheimer hails from Australia and had 12 years’ experience working in the post-EPR environment before moving to Canada.

How does the Australian EPR work?

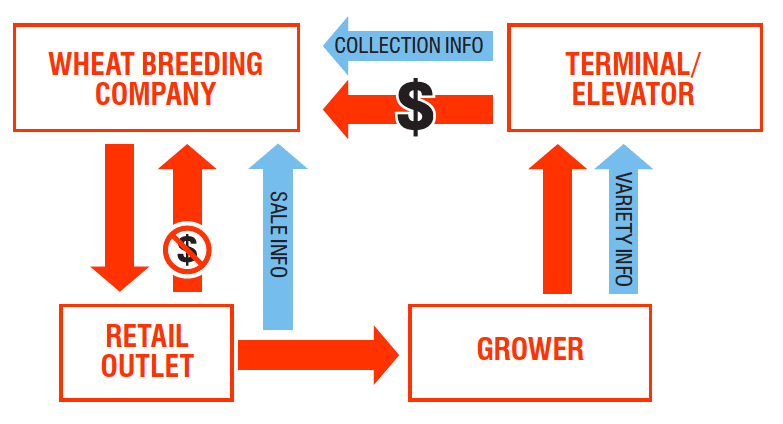

An EPR is a fee paid on every tonne of grain produced (and sold as grain) by growers for each particular variety. The EPR amount is set by the variety owner (breeder) when the variety is released and may vary between varieties. A Variety License Agreement outlines the terms and conditions of sale of varieties to growers and the resulting EPR obligations. With every sale of seed, a Variety License Agreement must be provided to the grower by the retailer.

Positives since the EPR system was put in place:

Increased investment in variety development. Investment has gone from $18 million in public investment to more than $45 million private investment at the moment. There are now as many wheat breeding plots per acre of production in Australia as there are corn breeding plots per acre of production in the U.S.

Larger pool of money for pre-breeding/discovery research. As investment levels from levies were maintained and refocused, more money is now being invested in pre-breeding research and therefore total investment (pre-research and variety development) is much higher.

Breeding targets are now better aligned with grower value. Breeders get direct feedback by product demand and royalty return so have sharper focus on delivering highest-value traits to farmers.

Increase in international relationships and germplasm exchange. All major multinational companies now invest in Australian wheat breeding and breeders have direct access to global breeding and germplasm networks.

Faster adoption of technology. Technology developed by all the major international breeding companies is being implemented in Australia. A race is on to deliver value from public research to farmers, which is increasing the intensity of competition and number of players in the space.

Jason Reinheimer: In His Own Words

Growing up on a mixed grain farm in Australia, Jason Reinheimer became enamoured with plant breeding in his teens, which led him to complete a PhD in plant breeding. After he finished school, he went to work at a small startup called Australian Grain Technologies (AGT), now Australia’s largest plant breeding company, where he had his own breeding program at a comparatively young age. He now serves as senior breeder for Limagrain Cereals Research Canada.

“My father was a farmer. The discussions we’ve been having in Canada about value creation are the same discussions I had with my father in the wheat field all those years ago about the exact same issues.

“Initially, public perception of Australia’s EPR system wasn’t great, and it’s similar to the reaction to value creation in Canada. During the transition, Australian growers viewed it as double-dipping at times. That’s understandable during a transition. Early on, the implementation of the EPR system in Australia was quite a challenge. Farmers did not like the paperwork associated with the initial EPR systems. Over time it has evolved and is now more or less seamless.

“With time, growers saw and realized the benefits that the new system was delivering as the newer varieties were brought to market.

“In the past, breeding could take 12 years from making the first cross to bringing it to market. Now we can do that in as short as five years. We can deliver more value faster, but we need investment in wheat breeding through a value creation system or else companies like us will not survive.”

What Challenges Does Australia Face with its  EPR Model?

EPR Model?

Public perception of “double dipping”. Australia maintained the existing levy rate and system when EPRs were implemented, causing some to view the system as forcing growers to pay twice for a variety.

Shifting value collection focus. The Australian seed industry had concerns that the end point royalty system takes the focus off of seed since royalties are collected on produced grain instead.

Royalty collection system development. A major coordinated effort to streamline the collection system has been made over the years. New license agreements, collection agreements and education/incentives for collecting agents have had to be developed to improve the system and help it to function better.

Competition with existing royalty-free varieties. Existing varieties prior to EPR were and remain royalty-free.

Royalty rate increase. A rapid increase from AUD$0.5 tonne to AUD$3/tonne was initially seen, causing concern. This has now stabilized.

Funding inconsistency for breeding programs. Due to the nature of the EPR system, low production years (for example, due to drought) reduces income stability for breeders.

EPR Model?

EPR Model?