Investing in the Next Generation

Schickler urged leaders from across government, business and non-profit organizations to invest in today’s youth to solve the greatest challenge of tomorrow’s generation — feeding nine billion people. “We must ask ourselves what we are doing to support today’s leaders, scientists and farmers who are feeding the world, and that next generation who will take our place,” Schickler added. “The collaborations and innovations that will increase global food security will be fuelled most of all by the enthusiasm of generations to come.”

Good Help Harder to Find

“Labour has become a strategic asset on the farm. In today’s industry, if you lose your workers, it could be a significant blow to your business,” says Jean Philippe Gervais, Farm Credit Canada’s chief agricultural economist. “An aging population, continued urbanization and immigration trends impact the pool of available workers and the ability to find good farm labour.” In a recent press release, FCC urged the agriculture sector to focus on a labour strategy. In a competitive labour market, producers and agribusiness owners need a strong employee recruitment and retention plan for permanent or seasonal workers, according to Gervais.

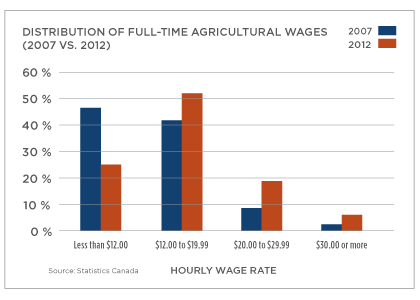

The demand for farm labour is strong due to growth in Canadian agriculture production, which has generally led to higher farm wages. Wages for full-time agriculture workers increased 22 per cent over the past five years, compared to an average 15 per cent wage increase across the entire economy, according to Statistics Canada.

Where is the Seed Treatment Segment Headed?

“However, an absence of centralized government regulations for treated seed and seed treatment active ingredient registration are expected to hamper the growth and demand for seed treatments in the next five years. One of the critical success factors in the market is the ability of a market participant to innovate a complete protection solution against various biotic and abiotic stresses in a single product. This battle of most of the grower-friendly, crop-friendly and environment-friendly product innovations is going to be one of the key strategy market players following the seed treatment industry in the next five years.”

Source: Seed Treatment Market: Global Trends, Forecasts & Technical Insights up to 2018, a MarketsandMarkets report

Agriculture Needs a Voice

The growing disconnect between agriculture and the public was a major theme at the 2013 Bayer CropScience Ag Issues Forum, held in February in Kissimmee, Fla., United States. The forum is an annual platform for media and industry to discuss those issues that will affect agriculture not just in the United States, but also around the globe. Speaker Michelle Payn-Knoper, author of the book No More Food Fights, emphasized this point by actually breaking a small plate before beginning her presentation. “I did that to make you realize that the plate is indeed broken between the farm and food sides of the public,” said Payn-Knoper. “It’s a very real challenge for us in agriculture to talk about ourselves because we think that we are too busy taking care of our crops and livestock to do so.” But folks in agriculture need to speak up for themselves, she said. “The reality is for agriculture that if your voice is not in the conversation somehow, someone else is probably speaking on your behalf,” said Payn-Knoper.

Trends in Biotech Production

“Biotech crop hectares increased by an unprecedented 100–fold from 1.7 million hectares in 1996, to over 170 million hectares in 2012. This makes biotech crops the fastest-adopted crop technology in recent times. In 2012, for the first time, developing countries grew more, 52 per cent, of global biotech crops than industrial countries at 48 per cent. In 2012, growth rate for biotech crops was at least three times as fast, and five times as large in developing countries, at 11 per cent or 8.7 million hectares, versus three per cent or 1.6 million hectares in industrial countries. Of the 28 countries which planted biotech crops in 2012, 20 were developing and eight were industrial countries; two new countries, Sudan (Bt cotton) and Cuba (Bt maize) planted biotech crops for the first time in 2012. Germany and Sweden could not plant the biotech potato Amflora because it ceased to be marketed. Stacked traits are an important feature — 13 countries planted biotech crops with two or more traits in 2012, and notably, 10 of the 13 were developing countries — 43.7 million hectares, or more than a quarter, of the 170 million hectares were stacked in 2012.”

—International Service for the Acquisition of Agri-Biotech Applications