The use of seed treatments to protect seed lots was one of the first crop protection measures to be practiced – today, seed treatments continue to improve from the ongoing development of new technologies and the market is projected to skyrocket in coming years.

FARMERS HAVE BEEN TREATING seeds in order to protect their crops since ancient times. Some of the first recorded seed treatments are the use of sap from onion, extract of cypress, ashes, olive residues and leek juice. Salt water treatments have been used since the mid-1600s and the first copper products were introduced in the mid-1700s. Other key milestones were the introduction of arsenic, used from 1740 until 1808 and the introduction of mercury, used from 1915 until 1982.

Until the 1960s, seed treatments had been only surface disinfectants and protectants. The first systemic fungicide product was launched in 1968. This systemic fungicide had not only seed surface activity but also moved into the plants protecting the young seedlings from airborne pathogens.

Since the 1990s the crop protection and seed industries have developed and adopted new classes of fungicide, insecticide and nematicide chemistry, expanding pest control while reducing user and environmental impacts.

Unprecedented Growth

With higher seed prices and new trait technologies promising higher yields and better agronomic performance, more and more growers are turning to seed treatments to protect their valuable investments. “There is a signifi cant return on investment for growers and they are now willing to protect that investment,” says Mark Jirak, crop manager for Syngenta Seed Care.

Terry Culp, vice president of the Seed Enhancement and Nutrient Business at Precision Laboratories, says growers are realizing here is not one silver bullet, but rather they see that, “it’s a combination of good genetics and agronomics and included in that now is ‘what other treatments or enhancements go into that’ and it’s not just one product but a combination of products.”

Indeed, seed companies are seeing the opportunity to help farmers protect the yield they purchase when they invest in seed and, as a result, new players are joining the game and new collaborations are being forged.

The majority of major row crops planted for 2010 will have at least some form of seed treatment. The global seed treatment market was estimated at over $2.5 billion USD in 2009 and will continue to grow as it is considered a cost-effective method to protect the increasingly valuable seed.

The Market

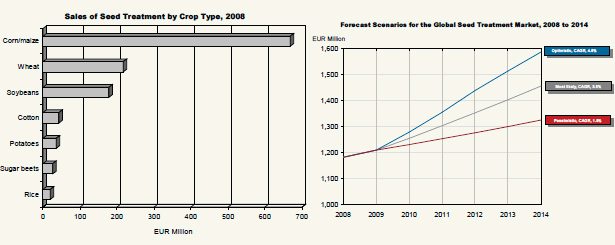

According to data from the report Seed Treatment 2009 Global Series: Market Analysis and Opportunities, conducted by worldwide consulting and research firm Kline & Company, the most rapidly growing markets are projected to be corn in Argentina and Brazil and soybeans in Brazil, growing at a rate above 7.5 percent.

Crop acres and higher seed costs are the main market drivers for seed treatment. Increased seed cost, especially in countries with high use of costly genetically modified seed types, have been encouraging growers to rethink their prior strategy of seeding at high rates to insure against losses due to insects and diseases. As a result, it has been even more important to protect the reduced plant populations by using the best available seed treatments.

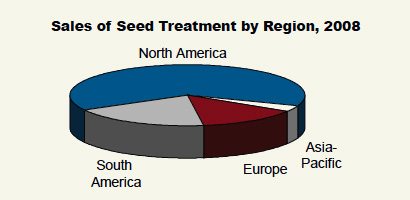

According to Kline’s report, the United States is the leading seed treatment market, accounting for more than 50 percent of the global markets studied. Brazil ranks second, accounting for more than 15 percent of the total. The seed treatment market is dominated by corn with other crops reported to be important including cotton, potatoes, rice, soybeans, sugar beets and wheat.

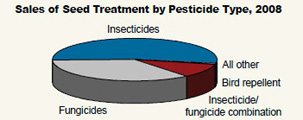

Sales by Pesticide Type

Fungicides are the leading seed treatment products on a hectaretreated basis with over 200 million hectares. Insecticides are used on about one-third of the seed treated area, but have a market value of 50 percent higher than fungicide treatments. The neonicotinoid seed treatments have been able to command a signifi cantly higher price by replacing soil applied applications and some early foliar insecticide applications.

Future Outlook

The seed treatment market is expected to increase at a growth rate of 3.5 percent annually. Of the regions, countries and crops analyzed, the most rapid growth will likely occur in the South American countries of Brazil and Argentina, specifically in the treatment of corn and soybean seeds.

According to some, it is collaborations and new innovations that will drive the future of the sector. “We’re going to see more companies coming together to pursue a product,” says Culp. “We’ll be looking for partners that can marshal joint resources to move a project forward.” Julie McNabb

Poised for Growth

The future looks bright for various areas of seed treatments including traditional inoculants, seed coatings and polymers which are all experiencing growth.

-

Becker Underwood of Ames, Iowa, a developer, marketer and producer of bioagronomic products for agriculture, and Plant Bioscience Limited of Norwich, United Kingdom, have signed an agreement granting Becker exclusive global marketing rights to patented new seed treatment technology. The technology uses a natural plant compound that “primes” the plant’s natural defense mechanisms so they are deployed more effectively when challenged by a pest.

-

Incotec recently acquired a Swedish company called Seed Guard, which has developed a very sophisticated patented disinfection method using hot air. The technology has been successfully used on a large scale with cereal seeds in Sweden. “This technology is 100% environmentally friendly and very suitable for sustainable agriculture,” explains David Pickenpaugh of Incotec. “The technology removes many diseases from seeds and does not require drying after treatment.”

-

Canadian-based Wolf Trax, Inc. has launched its Protinus seed nutrition platform in the U.S. and Canada, and plans to eventually launch the product in europe and Mexico as well. “Protinus is a unique, nutrition-based seed application product that has demonstrated early plant health benefi ts in a variety of crops and growing conditions,” says Jennifer bailes, director of Seed Products and Innovations at Wolf Trax. Bailes says the products currently being evaluated within the Wolf Trax short-term pipeline include a specialized pulse crop formulation, an enhanced cereal nutrition product and other proprietary formulations.