More could be on the line for seed companies that release new traits.

At the moment, biotechnology company Syngenta and more than 300,000 plaintiffs are focused on whether or not the company is liable for losses incurred back in 2013 when China stopped accepting shipments of U.S. corn it believed contained Syngenta’s Agrisure Viptera trait.

The lawsuit, which has been allowed to move ahead with class-action status, contends that Syngenta’s neglect in getting Chinese market approval for the insect-control trait caused corn prices to drop that year and asks for significant damages. An application to appeal the class-action ruling, filed by Syngenta, puts the number at $7.02 billion.

The plaintiffs in the suit did not necessarily ever grow Agrisure Viptera corn, but they claim that the release of the product before Chinese market approval damaged their profits as the price of corn dropped.

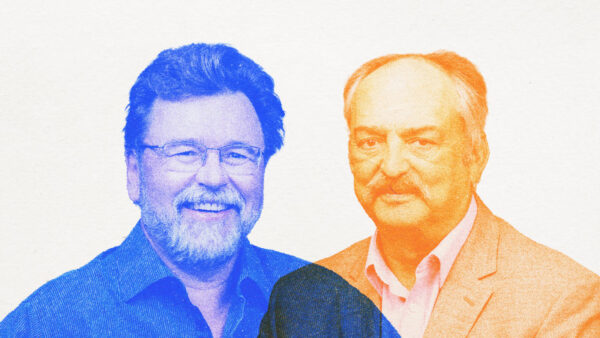

As noteworthy as that lawsuit is, there could be long-term implications based on its conclusion. Drew Kershen, professor emeritus at the University of Oklahoma College of Law, suggests that there are serious questions about a seed company’s responsibility to the market and whether or not that company might incur significant risk in bringing new traits online.

Kershen says biotech companies have agreed not to release seed to growers without getting approval from major markets. Syngenta sought approval from China but never received it. At the time, Kershen says, China imported little corn, but that changed.

“If a seed company has an obligation to obtain major market approval for the purposes of protecting the market, then what is a major market?” he asks. “This is a shifting term.”

Don Downing, one of the four co-lead counsels for the plaintiffs in the suit, says receiving market approvals hasn’t been a particularly heavy burden for seed companies.

“For responsible seed developers who follow generally accepted protocols in the industry, this should not be and has not been a problem,” says Downing, who is part of the law firm of Gray, Ritter & Graham, P.C., based in St. Louis. “There are all sorts of potential hypotheticals.

“But Syngenta knew what they were doing, knew the Chinese market was important, knew that China hadn’t approved the trait, and Syngenta released it anyway. The safest course is not to commercialize it in the U.S. until all important markets have approved it.”

That course, however, raises more questions for Kershen. He says China had been asked for approval of the Viptera trait after the U.S. approved it in 2010. Waiting for Chinese approval might have kept a product that Syngenta spent millions to develop off the market for years.

“If they are going to take three, four, five years to take action, that, in effect, puts these other countries in charge at a veto power level over what American farmers can grow,” Kershen explains.

That could stifle innovation. “There is a real risk that it will slow down, if not stop, the introduction of new traits until you get all these market approvals,” Kershen says.

Syngenta will say little until the litigation is settled, but seemed in a statement to echo Kershen’s sentiment.

“Syngenta firmly believes that the Viptera China lawsuits should be rejected and that Agrisure Viptera was commercialized in full compliance with regulatory and legal requirements,” according to the statement released by Paul Minehart, head of North American corporate communications for Syngenta. “We will continue to defend the rights of American farmers to have access to safe, effective, U.S.-approved agricultural technologies.”

More Questions

Kershen adds that the lawsuit also raises questions about new molecular breeding technologies. While most biotechnology products are created through rDNA techniques, others like RNAi and CRISPR-Cas, do not yet fall into the same classification. This lawsuit could have implications for how those technologies and their products move into the market.

“What this means is that seed companies will have to worry about using these new techniques for breeding because of concerns about ‘market impact’ liability,” Kershen says. “Companies may be very reluctant to adopt modern molecular science in breeding programs, depending upon the outcome of the Syngenta litigation.”

For now, the lawsuit is winding through the courts. Syngenta has asked 10th Circuit Court of Appeals to review the decision to allow class-action status. A decision could come within weeks.