Most people in the seed industry have heard of agricultural biologicals. Fewer people understand what biologicals are, how they are used, how big the market is, who the players are and what regulatory challenges the industry faces. Several comprehensive market research reports have been published on the topic. A report from Markets and Markets, titled, “Agricultural Biologicals Market by Function (Biocontrol, Biofertilizers, Biostimulants), Product Type (Microbials, Macrobials, Semiochemicals, Natural), Mode of Application (Foliar spray, Soil and Seed treatment), Crop Type, and Region – Global Forecast to 2025” estimates that the global agricultural biological market size $8.8 billion in 2019 and is projected to grow at a CAGR of 13.6% to reach a value of $18.9 billion by 2025.

Data from the Markets and Markets paper is complimented with a new paper published in September, IDTechEx, a market research firm that provides clients in 80 countries with market intelligence on emerging technologies, published a new report titled, “Biostimulants and Biopesticides 2021-2031: Technologies, Markets and Forecasts: An overview of agricultural biologicals, including natural products, semiochemicals and the plant microbiome”. Both reports shed light on the market size, the key players, as well as the constraints and opportunities.

Basics

Agricultural biologicals are biostimulants, biopesticides and biofertilizers. Like their non-bio counterparts, these are products improve nutrient uptake and tolerance of stresses, kill pests, and promote plant growth without the use of synthetic inputs. They are largely viewed as a more sustainable way to boost yields and provide new methods of crop protection. The environmental benefits are critical at a time, when agriculture is being painted as a major cause of climate change as well as a possible savior.

Application of chemical fertilizers and pesticides have grown in recent decades. Fertilizers are linked to groundwater pollution and eutrophication. Plus, a life cycle analysis shows that fertilizer production is a significant source of greenhouse gas emissions. Similarly, concerns about chemical pesticides include potential damage to ecosystems and human health. There is also a growing problem of pesticide resistance in species of weeds, insects and fungi, limiting the tools available to farmers. Finally, in recent years, chemical registrations have been reviewed and pulled in Canada and the European Union, reducing marketplace predictability.

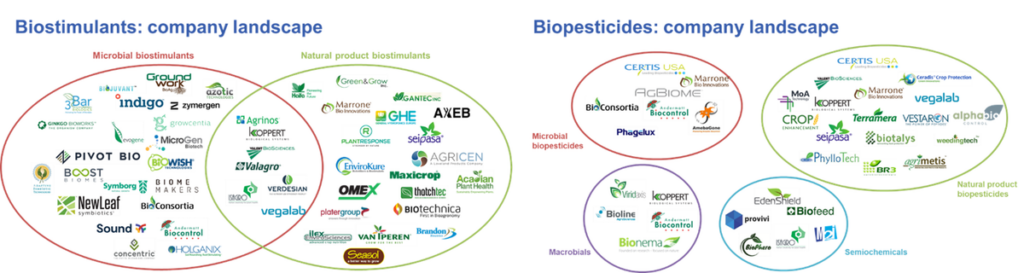

Companies

The IDTechEx reports identifies over 50 companies that produce microbial biostimulants or natural product biostimulants. Plus, another 30 companies that produce biopesticides. These products are broken into four categories, microbial biopesticides, macrobiais, natural products biopesticides, and semiochemicals. These companies are located all over the world. Markets and Markets reports major players include, BASF SE (Germany), Syngenta (China), Marrione Bio Innovation (US), Isagro (Italy), UPL (India), Evogene (Israel), Bayer (Germany), Vegalab (US), Valent (US), Stockton (Israel), Biolchim (Italy), Rizobacter (Argentina), Valagro (Italy), Koppert Biological Systems (Netherlands), Lallemand (Canada), Symborg (Spain), Andermatt Biocontrol (Switzerland), Seipasa (Spain), and Verdasien Life Sciences (US).

Full Reports

Looking for more information on biologicals, listen to Seed World PRO’s interview with CTO Dr. Molly Cadle-Davidson.