Since the mid-1980s, the European Framework Programmes (FPs) have been the main funding tool for Research and Innovation (R&I) in Europe. Each FP reflects strategic goals, with the agrifood sector playing a pivotal role—not only in addressing global food demands but also in contributing to economic, cultural, and social priorities.

At the end of last year, we published a report analysing trends in R&I funding for plant breeding from FP7 through Horizon 2020 and the first half of Horizon Europe. The findings revealed critical insights into the funding landscape, highlighting both progress and areas for improvement.

Key Findings

Stagnant Public Funding Growth for Plant Breeding R&I

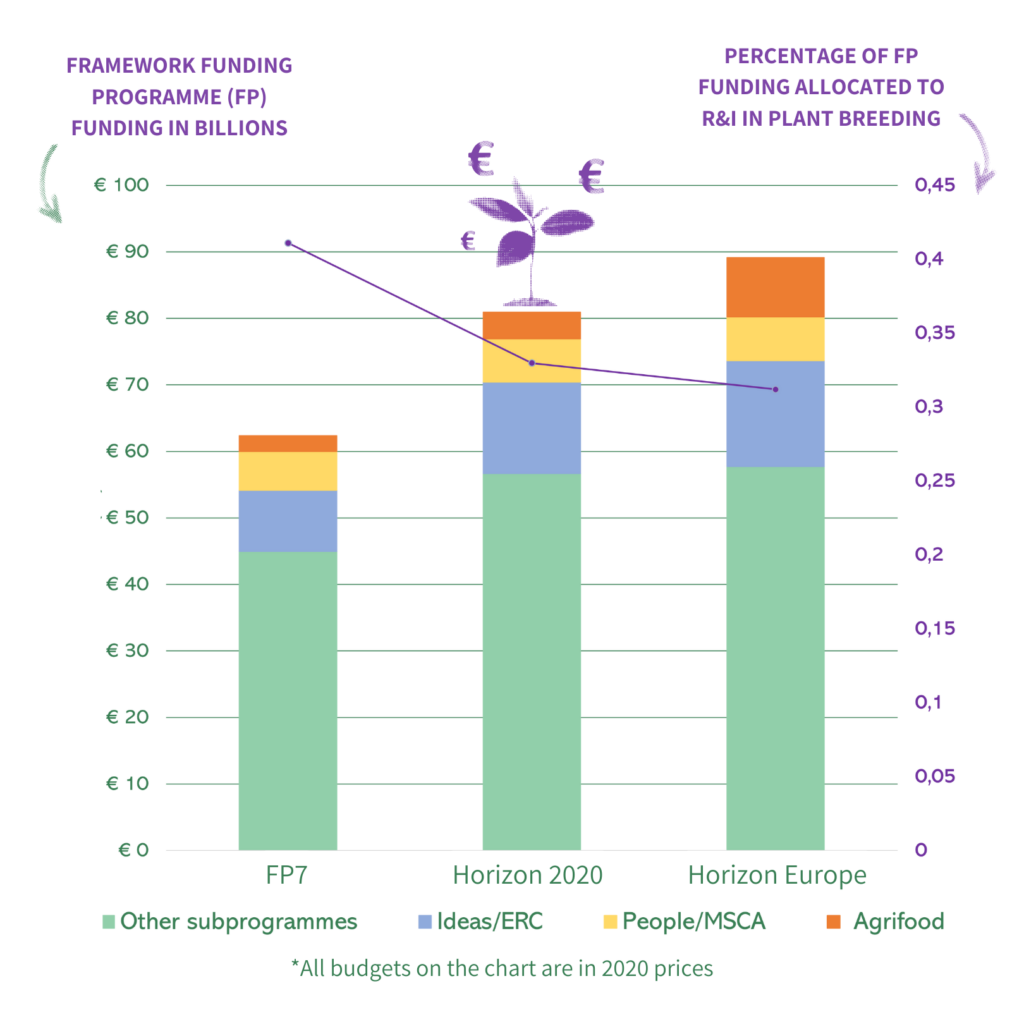

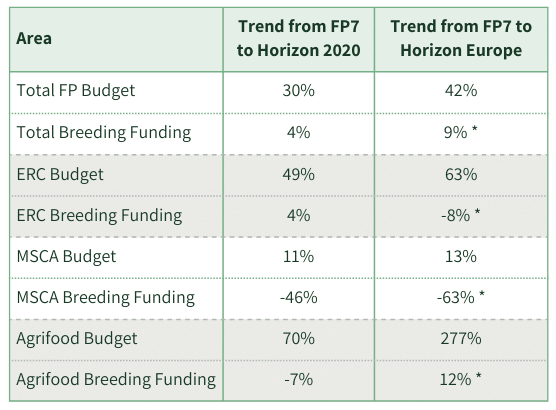

While the total FP budgets have increased by 42% over the past 20 years, funding dedicated to R&I in plant breeding has seen only modest growth, projected to rise to 9% by the end of Horizon Europe if current trends continue. This is despite a substantial 277% increase in the Agrifood sub-programme budget, the primary source of plant breeding R&I funding, over the same period. Consequently, funding allocation for plant breeding R&I has declined compared to the total FP funding, with Horizon 2020 seeing the sharpest reduction.

Declines in Bottom-Up Sub-programme Contributions

Along with the ‘top-oriented’ Agrifood sub-programme, the ‘non-oriented, bottom-up’ European Research Council (ERC) and Marie Skłodowska-Curie Actions (MSCA) sub-programmes, collectively account for 94% of funding for plant breeding R&I.

ERC funding has grown by 63% since FP7 and MSCA by 13%. But their allocation to plant breeding is expected to drop by 8% and 63% respectively compared to FP7, if trends from the first half of Horizon Europe continue.

Consortium Size vs. Project Budgets

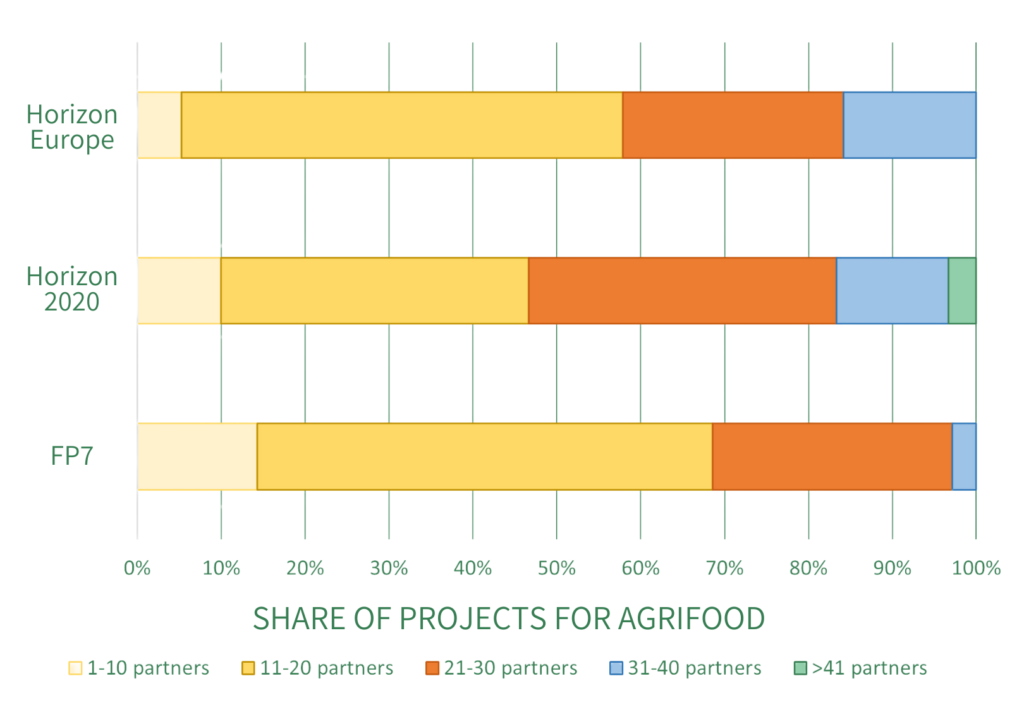

Projects related to plant breeding in the Agrifood sub-programmes have grown in consortium size from an average of 17 partners in FP7 to 21 in Horizon Europe. However, project budgets (around €5.5 to €5.9 million) and durations (4-5 years) have remained stable, suggesting reductions in funding per partner and limitations in the maximum duration of projects.

Given that developing new plant varieties is a long-term effort, the current budgets do not support projects long enough for research outcomes to be applied effectively within their lifespan.

Loss of momentum in the use of NGTs and GM

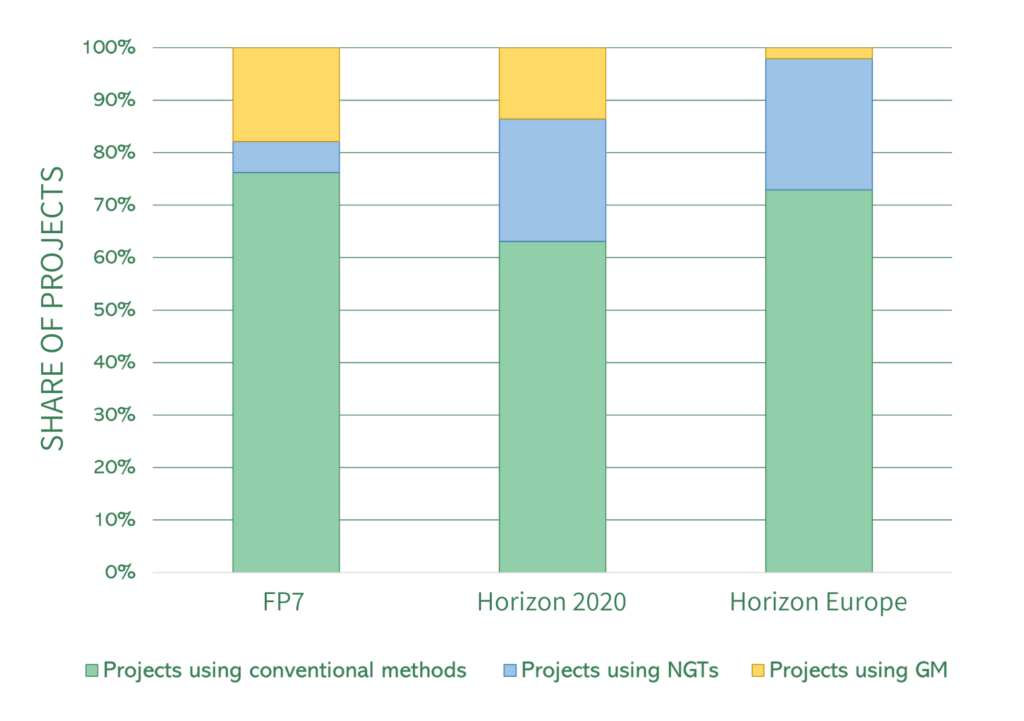

The use of innovative methods like New Genomic Techniques (NGTs) and Genetic Modification (GM) in plant breeding projects rose from 24% in FP7 to 37% in Horizon 2020 but has regressed in Horizon Europe due to regulatory uncertainties and restrictive research calls. GM usage has nearly disappeared, and the momentum for using NGTs has gone back to FP7 levels.

Private Sector Involvement

Private sector involvement in EU plant breeding R&I has grown from 29% in FP7 to 35% in early Horizon Europe. However, private partners in multi-partner projects typically receive half the funding that public sector partners do, while providing in kind contributions. Across Horizon 2020, private sector participants made up 28% overall, yet in plant breeding R&I, they represented only 20%, indicating more potential to enhance private sector participation in EU-level R&I for plant breeding.

Addressing the Challenges

Plant breeding has been pivotal, driving 67% of agricultural productivity gains in the past two decades. Beyond productivity, its potential to address challenges such as food security, climate resilience, and biodiversity conservation underscores the need for greater investment. However, unlocking this potential requires strategic investment and coordination at the EU level.

Recent policy developments, such as the Strategic Plan for Horizon Europe and the Strategic Dialogue on the Future of Agriculture, have highlighted the importance of plant breeding innovation. Similarly, the report on European competitiveness emphasises bridging the innovation gap by leveraging more public-private partnerships, and investing strategically in R&I.

As a result of our report’s findings, and to fully harness the potential of plant breeding in achieving the EU Green Deal goals for more resilient, competitive and sustainable agrifood systems, we, Plants for the Future, put forward the following recommendations:

Recommendations

- Increase funding allocation for R&I in plant breeding by implementing a dedicated, strategic EU-wide coordinated mechanism to support R&I in plant breeding, ensuring close collaboration between the public and private sectors, for maximum impact.

- Promote, or at least do not restrict, the use of plant breeding innovation in plant breeding-relevant calls, so that Europe does not fall behind its global competitors.

- Provide adequate funding in research calls to enable longer-term plant breeding-related projects, thereby ensuring research outcomes can be fully exploited within the lifetime of the project, or through dedicated research calls aimed at the continuation of successful projects.

- Attract more participation of the private sector in plant breeding-related projects by reducing administrative burden and ensuring sufficient funding.

By addressing these challenges and implementing these recommendations, Europe can unlock the full potential of plant breeding to transition towards more resilient, competitive and sustainable agrifood systems. Plants for the Future will continue to highlight the important role plant breeding plays in our agrifood systems.

We hope to see the new Commission better leverage plant breeding as a crucial tool to support many of its policy goals, but for that more strategic and collaborative action is needed.

Plants for the Future ETP is a multi-stakeholder platform representing the plant sector from fundamental research to crop production and distribution. We bring stakeholders from the plant sector together to consider the challenges and opportunities of agricultural value chains holistically, while developing a vision for future systems spanning food, feed, and biobased raw materials.