With a record corn harvest projected this year, the U.S. has an opportunity to strengthen its leadership position in corn exports… but will global competition and evolving trade dynamics get in the way?

Corn touches nearly every part of the U.S. economy — from the grocery store and gas station to export markets and biofuel plants. Its versatility, combined with its massive scale of production, makes corn an economic pillar that underpins the U.S. agricultural sector and its broader economy and, more specifically, the seed sector. So what’s ahead?

Andrew Swanson, an agricultural economist for the University of California, Davis (UC Davis), emphasizes that while the U.S. corn industry continues to dominate, emerging technologies, evolving policies and the rise of international competition offer exciting new possibilities, but also pressing challenges.

“We’re looking at a possible record U.S. corn crop this year, with yields pushing over 180 bushels per acre, far beyond what we saw just a decade ago,” Swanson says. “That abundance is driving prices down, and now all eyes are on Brazil’s growing season to see if it will shake up the export market.”

Corn’s Role in the U.S. Economy – Past to Present

Corn is the largest crop grown in the U.S. both by acreage and total production. American producers harvest approximately 15 billion bushels from about 90 million acres, making the United States the world’s leading producer of corn and contributing approximately $60 billion annually to the U.S. economy. Fluctuations in corn prices can push this figure higher, with the crop’s market value reaching closer to $75 billion when demand is strong. Although agriculture, including all crops and livestock, makes up only about 5% of the total U.S. economy, in states like Iowa, Nebraska and Illinois, corn is an economic cornerstone that sustains local economies and rural communities.

Technological innovation has played a pivotal role in increasing corn productivity over the past several decades. In the 1940s, corn yields averaged 30 bushels per acre. Today, they push six times that, driven by advances in hybrid seed genetics, biotechnology and precision agriculture. The introduction of genetically engineered (GE) corn varieties, first commercialized in 1996, has allowed farmers to dramatically increase their output. Today, more than 90% of U.S. corn acres are planted with GE seeds that are resistant to pests and herbicides.

“In the 1940s, corn genetics were nowhere near as advanced as they are today,” explains Swanson. “Larger, more efficient equipment and better inputs such as fertilizers and pesticides have also contributed to the U.S. maintaining its lead in corn production.”

Corn’s dominance in the U.S. agricultural sector is relatively new. Historically, wheat held the title as the dominant U.S. grain crop, but a shift in agricultural policies and trade dynamics in the latter half of the 20th century made corn and soybeans more profitable.

“Corn began overtaking wheat in the 1980s and ’90s,” Swanson says. “This increase in corn acreage has reshaped the agricultural landscape, particularly over the last 20 years.”

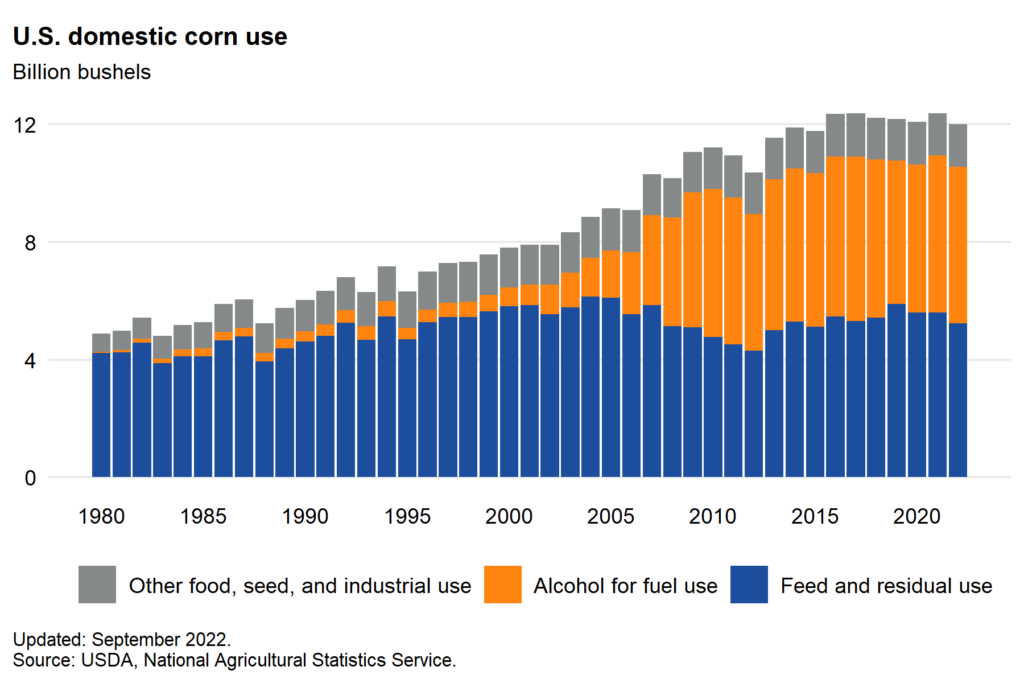

Today, more than 40% of U.S. corn production is used as livestock feed for cattle, pigs and poultry. The entire livestock industry, supported by corn feed, has an economic value that annually exceeds $100 billion. Corn is also used domestically as a key ingredient in many processed foods, playing a pivotal role in the $1-trillion U.S. food industry. Increasingly, corn is a key ingredient in pharmaceuticals, where corn-derived products like sorbitol are used in oral care products and medications, and in consumer goods including a variety of industrial products such as adhesives, plastics and biochemicals. Corn-based products are also progressively being developed for biodegradable packaging, bio-based plastics and textiles, creating an expanding market for sustainable goods.

Biofueling Growth & Future Opportunities

A major driver of corn demand over the past two decades has been the rise of ethanol. Roughly 30% of the U.S. corn harvest now goes into ethanol production. In 2022 alone, U.S. ethanol production reached 15.5 billion gallons, supporting more than 70,000 jobs across rural America. As a renewable energy source, ethanol has been championed for its role in reducing greenhouse gas emissions and providing a domestic alternative to fossil fuels. Over the past two decades, the ethanol industry has significantly grown, driving rural economic development and creating a steady market for corn farmers.

However, ethanol’s future is less certain than it once was. Domestic demand, particularly in the vehicle sector, has plateaued, particularly as electric vehicles (EVs) become more popular and fuel efficiency standards rise. By 2030, EVs could make up nearly 40% of new car sales in the United States, potentially reducing the need for liquid fuels derived from corn.

Despite these trends, Swanson remains optimistic about ethanol’s future, particularly in the aviation sector.

“I don’t anticipate there being battery-operated planes any time soon,” he says.

The U.S. government has set ambitious targets for sustainable aviation fuels (SAF), aiming to produce three billion gallons by 2030 to help decarbonize the aviation industry. Ethanol, already widely produced and integrated into fuel infrastructure, could play a significant role in this transition.

“There’s a lot of excitement about using ethanol as an alternative aviation fuel,” Swanson says. “If it’s adopted on a large scale, it could boost ethanol demand by 10 to 20%, giving the industry a new growth trajectory.”

Brazil on the Rise

While corn’s sheer scale in the agricultural sector is impressive, its role is not static. Domestic demand for corn remains strong, but U.S. corn growers face increasing competition pressure for the 15-20% of U.S. corn production that hits international markets.

Brazil, which annually produces approximately five billion bushels of corn, has emerged as a formidable competitor. Though it only produces about one third as much corn as the U.S., Brazil in 2019 and 2022 surpassed the U.S. in corn exports. Swanson says Brazil’s success is largely due to favorable trade agreements, particularly with China.

Historically, China was a top buyer of U.S. corn, importing billions of bushels each year to feed its growing population of now 1.41 billion. However, the U.S.-China trade war, which began in 2018, significantly altered this dynamic. Tariffs imposed by both countries led to higher costs and disruptions in trade. This opened the door to Brazil, from which China imported over 80% of its corn in 2022.

“Brazil and China have worked out trade deals that have allowed Brazilian corn to flow into China more easily,” Swanson explains. In contrast, U.S.-China tensions have put pressure on trade relations, creating new challenges for U.S. corn exporters.

Looking Beyond China

Looking forward, it is critical that the U.S. agricultural value chain explores new markets and strengthen trade relationships beyond traditional partners like China. Swanson says the reality is “our exports haven’t grown much in the past 20 years,” despite growing production.

On a positive front, the U.S. maintains strong trade relationships with multiple other regions, particularly Japan and — for now— Mexico, which buys roughly 25% of U.S. corn exports, he says.

However, that relationship is facing rocky waters due to Mexico’s concerns with genetically engineered corn.

“That’s up in the air right now,” Swanson says. “It could be just trade negotiation tactics where Mexico is trying to get more favorable terms for the next time they negotiate the U.S., Mexico and Canada agreement — or it could be a real issue.”

To maintain its leadership in corn exports, Swanson asserts that the U.S. should look beyond traditional markets and explore new opportunities in developing regions. As populations grow in oceanic and pacific regions – namely the Philippines, Indonesia and India – demand for corn-based products is expected to rise.

“These growing, younger economies present a big opportunity for U.S. farmers,” Swanson explains. “Countries with increasing populations and expanding middle classes are going to need more food and fuel, and corn can help meet that demand.”

Charting Corn’s Future

With a massive crop expected this year, prices may remain suppressed, but it’s important to note that the corn market is both global and volatile. Weather disruptions in Brazil or China could quickly change U.S. corn producers’ outlooks and incomes.

“With such a large crop, prices are dropping, making global markets essential,” Swanson explains. “If Brazil faces crop issues, it could create new export opportunities for us as well.”

One of the bigger global market impacts could be China’s own corn production. Extreme weather from heat waves to floods has impeded China’s production this year. Bloomberg predicts output this year could drop by between five- and 20-million tons, leaving a gap that U.S. corn might have opportunity to fill.

Looking ahead, U.S. farmers will need to stay nimble, adapt to global trends and embrace new technologies to stay competitive in an increasingly crowded field. Swanson believes that technological advancements, domestic demand and opportunities for biofuels will keep driving growth. He also remains optimistic about improving trade relations with China and exploring new export opportunities.

“Long term, adapting to shifts in the global economy will be key and recognizing areas for expansion and growth in new and existing markets present exciting potential for U.S. corn producers to thrive in the years ahead,” he says.