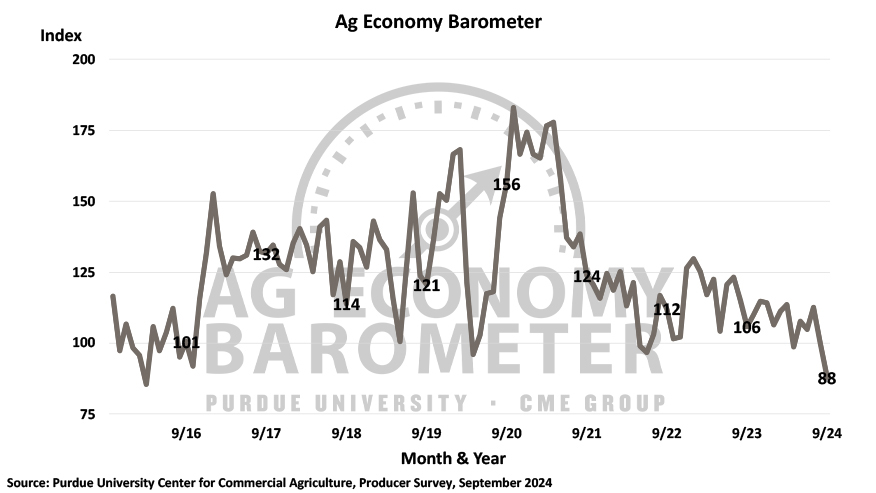

Weakened income expectations lead to lowest farmer sentiment levels since 2016.

In September, the Purdue University/CME Group Ag Economy Barometer, a nationwide measure of the health of the U.S. agriculture economy, dropped to its lowest readings since March 2016. The barometer is based on a survey conducted each month with 400 agricultural producers. September’s survey was conducted between September 9 and 13, 2024.

September’s decline measured 12 points, bringing the barometer to a total of 88, according to a release. Declining income expectations contributed to the dip, with the Index of Future Expectations also falling 14 points to 94. In addition, the Index of Current Conditions decreased by 7 points to 76, which is nearly as low as the levels observed during the peak of COVID-19 concerns in April 2020.

The results indicate a growing anxiety among farmers regarding commodity prices, input costs, agricultural trade, and the potential effects of the upcoming election on their operations. When asked about their main concerns for the coming year, 34% of farmers cited high input prices, while 33% pointed to low commodity prices. Interest rates were a top concern for 17% of respondents.

Farmers’ worries about commodity prices align with their lack of confidence for the future of U.S. agricultural exports; only 26% expect exports to increase over the next five years, the lowest optimism recorded since this question was first asked in 2019. Additionally, 78% of producers were concerned that policy changes after the fall 2024 elections could impact their farms.

“The continued drop in the barometer reflects deepening concerns among farmers regarding expectations for farm income in 2024 and 2025,” James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture, said. “It’s notable that producer sentiment dropped back to levels last seen in 2016 when the U.S. farm economy was in the early stages of an economic downturn. In addition to commodity prices and input costs weighing heavily on their operations, producers are also facing considerable uncertainty about what lies ahead for their farms with the possible government policy changes following the upcoming 2024 election.”

The Farm Financial Performance Index decreased from 72 in August to 68 in September, making September the third consecutive month of decline. This is a notable drop of 18 points compared to a year ago, when the index was at 86. While the Farm Capital Investment Index rose by 4 points to a reading of 35, it remains just above its all-time low, suggesting that many producers do not see the current financial reality to be a favorable time for major investments.

This September’s survey marks the fourth consecutive year that the barometer asked corn- and soybean-producing respondents for input about cover crop usage. Similar to previous years, over half of the respondents reported that they plant cover crops on part of their farms, while another 20% indicated they had done so in the past. Notably, farmers who use cover crops today report dedicating a larger portion of their acreage to cover crops compared to previous years. In 2021, 41% of cover crop users reported planting them on over 25% of their farmland. This figure increased to 50% in 2023, and this year, 68% of cover crop users indicated they are planting cover crops on more than a quarter of their farms.

The Short-Term Farmland Value Expectations Index dropped by 10 points to 95, marking the first time since 2020 that the index fell below 100. This indicates that more farmers expect a decrease in farmland values over the next year than those anticipating an increase. The change from a positive to a weaker outlook stems from a notable decrease in producers forecasting rising values, coupled with an increase in those expecting values to hold steady.